China Perfume Market: Key Trends in the Chinese Perfume Fragrances Market for 2025

The Chinese fragrance market has experienced robust growth in recent years, which explains why the number of foreign fragrances is accelerating their entry into the Chinese market, while domestic brands are also witnessing significant development.

With consumers increasingly seeking higher quality and more distinctive products as their living standards rise, there is a growing demand not only for pleasant scents and experiences but also for functional benefits such as enhancing the quality of life, relieving stress, and uplifting moods.

Perfume and fragrance products, being comprehensive consumer goods, are poised to play an increasingly important role in meeting consumers’ demands for improved quality of life in the future. Moreover, the development of internet technology, online channels, and e-commerce is further expanding the market for the fragrance industry, indicating that the Chinese perfume and fragrance sector will continue to be a rapidly growing market with significant potential for both international and domestic brands, albeit with accompanying opportunities and challenges.

Consumer Profile

Fragrance encompasses various products, including perfumes, candles, reed diffusers, car fragrances, paper fragrances, and other fragrance products. Different fragrance products attract distinct consumer demographics.

According to research data from CBNData in April 2023, among consumers aged below 30 who are either single or in the early stages of marriage without children and possess relatively lower purchasing power, there is a higher proportion of perfume consumers. On the other hand, consumers aged 30 and above, who have established families and may have children, show more purchasing power in fragrance products, but they are still interested in buying perfume.

The most popular fragrance category is floral fragrances, but fruity fragrances, woody aromas and actual fragrances are also in high demand.

Current State of the Chinese Fragrance Industry

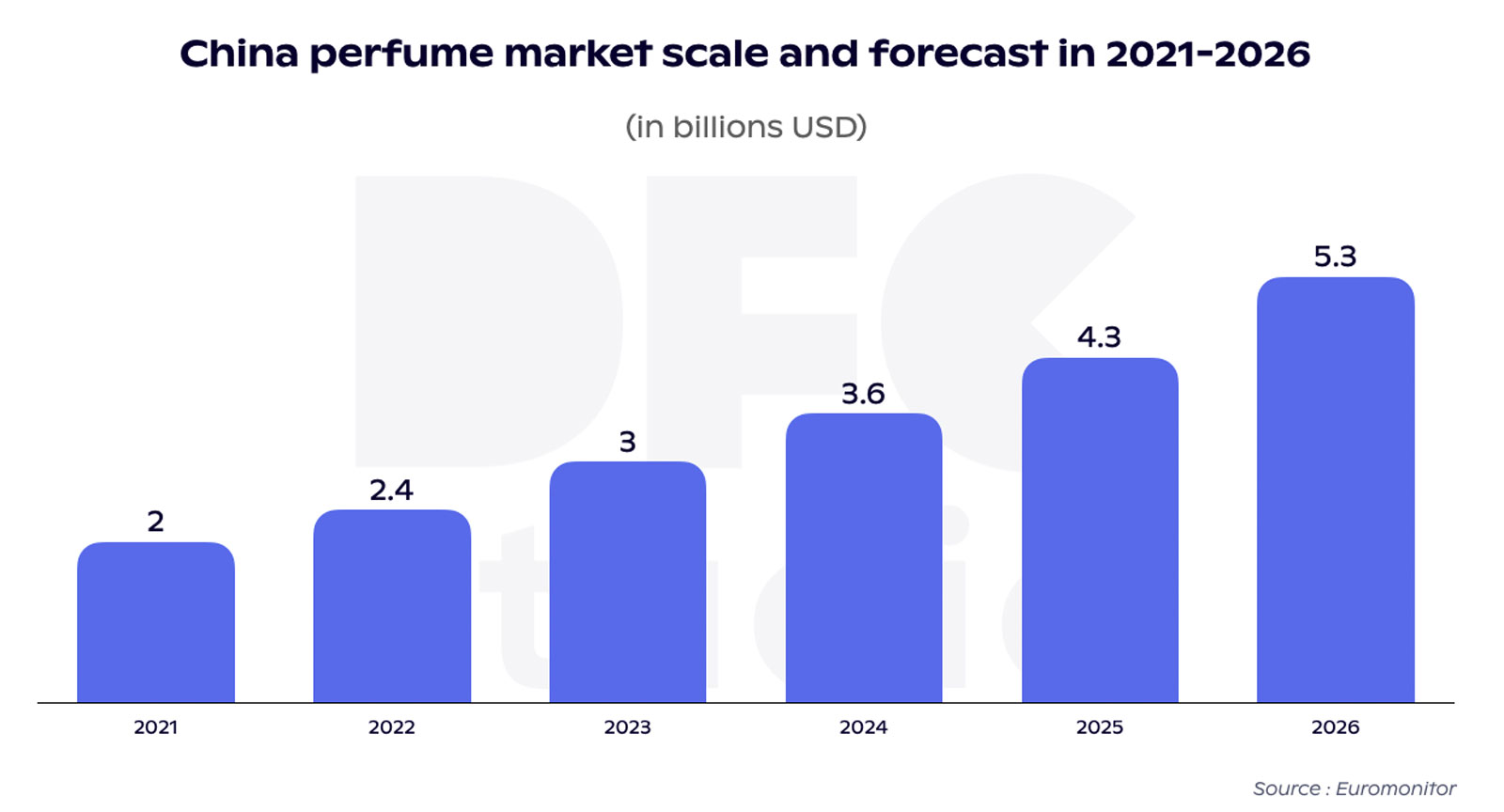

The Chinese perfume market is currently experiencing rapid growth, albeit with a market penetration rate still significantly lower than that of the Western market, indicating substantial growth potential. China Perfume Market Reports forecast that the Chinese perfume market will reach $5.3 billion by 2026, showing a rapid growth trajectory.

In recent years, consumers’ attention to fragrance products has been steadily increasing, leading to the rise of olfactory economy, with various fragrance products becoming more prevalent in daily life. The types of products are also becoming increasingly diverse, including perfumes, essential oils, and scented candles.

Chinese fragrance brands mainly fall into three categories: mass-market brands, high-end brands, and niche brands. Commercial fragrances occupy the majority of the market share, accounting for approximately 110 billion yuan, while niche brands comprise only 5.9%.

As Chinese consumers’ demand for fragrance products’ quality continues to rise, there will be significant growth opportunities for niche brands and categories. Moreover, fragrance products are predominantly used in home settings, offices, leisure venues, and entertainment venues, indicating that fragrance products will increasingly be applied in various social settings in the future.

The Rise of Local Perfume Brands

In the Chinese fragrance market, Chinese brands hold considerable sway, with notable players leading the charge in niche fragrances steeped in the country’s rich cultural heritage.

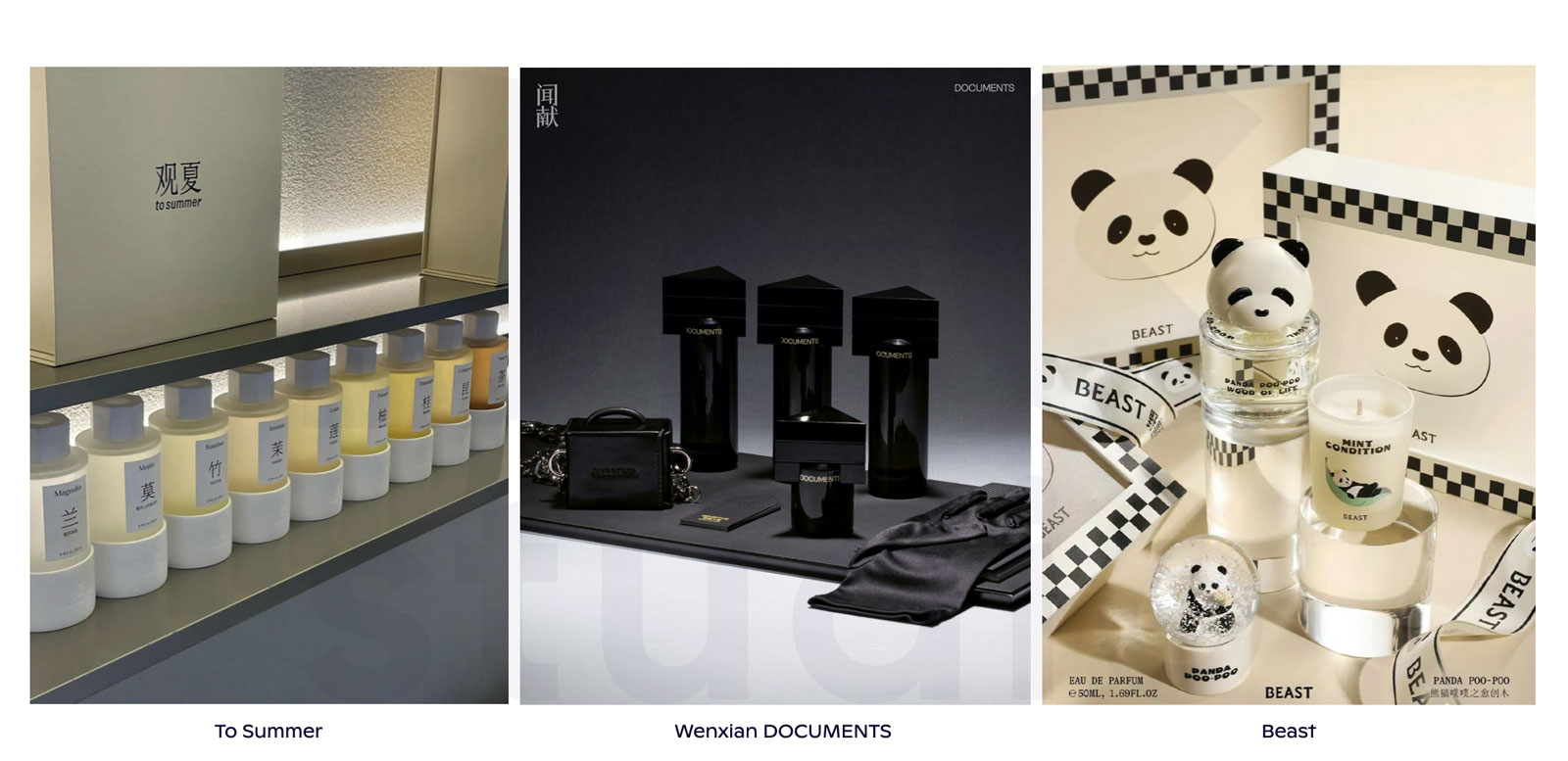

To Summer: Founded in 2018, To Summer is an oriental cultural fragrance brand that draws inspiration from Eastern culture and art to create fragrances that resonate with the senses. The brand focuses on Chinese cultural elements, emphasizing marketing narratives over products.

DOCUMENTS: This brand exclusively offers concentrated perfumes, using Chinese ingredients and minimalist designs to create long-lasting scents. With a high price point comparable to Chanel, it leverages Confucian culture for branding. In 2022, L ‘Oreal Group’s Meifang Investment company announced its commitment to China’s local high-end perfume brand DOCUMENTS.

Beast: Established in 2011, Beast extends its product range through independent research and curated selections. It launched perfume products in 2020, incorporating narrative elements reflecting the zeitgeist. Positioned as a high-end lifestyle brand, it collaborates with celebrities to promote fashion and taste, emphasizing natural and fresh fragrance products.

These brands showcase the diversity and innovation within the Chinese fragrance industry, blending traditional cultural elements with modern sensibilities. Some other growing niche fragrance brands worth following include Scent Library, Boitown, and Maison Dixsept.

Chinese Fragrance Marketing Trends

As Chinese consumers’ demand for improved quality of life and spiritual fulfillment grows, the olfactory economy emerges as a trend, leading to the diversification and personalization of fragrance products. The development of the fragrance industry can be summarized in three directions:

Healing: Advanced fragrance enthusiasts seek finer fragrance experiences and increasingly value the emotional healing and cultural experiences provided by fragrance products(The Proust Effect). Fragrances are also used to regulate emotions and relieve stress, presenting a direction for fragrance development.

Chinese Culture Integration: Modern perfumery, originating in 14th-century Europe, dominates the international perfume market today. However, China’s rich history of fragrance dates back much further, with fragrance practices deeply embedded in Chinese culture. Brands like To Summer, Beast, and DOCUMENTS highlight Chinese cultural elements, appealing to the growing interest in traditional Chinese culture among young consumers.

Experiential Consumption: Experiential consumption is becoming increasingly important in olfactory consumerism. Deep cultural experiences require immersion, leading to the emergence of offline fragrance-themed venues that attract consumers.

Offline perfume flagship stores, scent museums, and fragrance workshops in various novel forms are created to enhance the fragrance experience. Besides providing a more tangible product experience, consumers also expect to gain further knowledge about perfumery, the history and culture of fragrances, and the story and philosophy behind products and brands.

There is a strong desire for offline experiences, as evidenced by the grand opening of the first MANE Perfume Creative Center in Shanghai’s bustling K11 district on March 6, 2024, signifying the importance of offline spaces in the Chinese market.

These brands showcase the diversity and innovation within the Chinese fragrance industry, blending traditional cultural elements with modern sensibilities.

Social Media’s Impact on the Perfume Industry:

Social media platforms and online platforms play a significant role in driving the growth of the perfume industry, particularly among young Chinese consumers. Users often obtain fragrance information from platforms such as Xiaohongshu (RED), WeChat, Weibo, and Douyin (TikTok), with a high level of trust in Xiaohongshu. They are willing to try products recommended on these platforms, with this behavior being particularly prominent among users aged 23 to 25.

Xiaohongshu enjoys high reach and trust among perfume users, and social media platforms like Xiaohongshu are driving consumer market growth comprehensively. Perfume consumers trust fragrance information on Xiaohongshu, with 60.8% of respondents obtaining fragrance information from the platform. This demographic of users primarily falls within the age range of 18 to 25 when they initially start using fragrances. Various types of fragrance-related posts can be found on Xiaohongshu, with the top three types being “targeted recommendation posts,” “collection recommendation posts,” and “fragrance selection advice posts.” Xiaohongshu has even seen the emergence of a trending topic with over 3.8 billion views: #Today’sFragrance#, with total post interactions exceeding 57 million in the past three months. If you’re interested in Xiaohongshu, check out our previous article dedicated to it.

It is important to note that offline channels such as offline stores, beauty speciality stores, and department stores remain key touchpoints for creating an experience and increasing perfume sales.

Conclusion

The Chinese perfume industry is rapidly evolving, driven by consumer demands for luxury perfumes and personalized experiences. Experiential consumption, through offline venues and customized workshops, is on the rise, deepening consumer engagement.

Social platforms, such as Xiaohongshu, as well as e-commerce platforms including Tmall and Tmall Global play a pivotal role in driving consumer awareness and fragrance sales. As the industry expands, foreign brands must embrace experiential marketing and leverage social media to thrive in order to meet consumer preferences. Fragrance is not just a product but an emotional experience, poised for continued growth in China’s dynamic market.

Want to Succeed in China? Download Our Free 84-Page Strategic Guide

Want to Succeed in China? Download Our Free 84-Page Strategic Guide

Keep up with the latest trends

DFC Studio is a Beijing-based digital marketing and e-commerce agency specialized in the Chinese market.

From strategizing your market entry to fostering brand recognition, our mission is to facilitate your expansion in order to boost your sales.

What sets us apart is our team of highly accomplished professionals, all of whom are graduates from renowned international universities.

This unique blend of bicultural expertise and deep understanding of the Chinese market positions us as a great partner to unlock your brand’s full potential in this thriving landscape.