Top 16 Chinese Social Media & E-commerce Platforms to Know in 2025

China’s social media landscape is vast, complex, and highly unique. While global platforms like Facebook, Instagram, and Twitter are blocked, China has developed a thriving ecosystem of social media apps catering to its huge, diverse population.

With over 1 billion Chinese internet users, the country’s digital environment is a goldmine for brands seeking to reach a larger audience. However, tapping into this market requires a deep understanding of not just the platforms themselves, but also the unique characteristics of users across different regions and demographics.

In recent years, the integration of online payments, social commerce, and live streaming has revolutionized how Chinese consumers interact with brands. This article provides an overview of key platforms, explores the latest social media marketing trends, and outlines strategies that brands can use to engage consumers.

China’s social media ecosystem is vast and varied, led by major platforms catering to diverse demographics and content needs. From multifunctional super apps to niche platforms for videos or social commerce, each plays a unique role in China’s digital landscape, making platform-specific insights essential for brands.

Here are the most important ones brands should know:

1. WeChat

Overview

WeChat remains the dominant player in China’s social media landscape, with over 1.3 billion monthly active users (MAU). It’s a true super app that combines messaging, social networking, mobile payments, and e-commerce.

User Demographics and Statistics

WeChat’s users are spread across different age groups, but the majority fall between ages 18-40. Around 54% of users are male, and 46% are female.

For many users, WeChat is inseparable from everyday life, with people spending an average of 70-90 minutes per day on the app. The ability to pay for goods and services through WeChat Pay further strengthens its grip on users’ daily routines, making it essential for brands to leverage WeChat’s capabilities.

WeChat’s user base spans across all city tiers, though it is especially prevalent in 2nd and 3rd-tier cities, where tech-savvy consumers rely on the platform for everything from communication to shopping. While it has strong penetration in urban areas, it is also growing in popularity in lower-tier city consumers, especially as mobile users in these regions gain more access to smartphones and internet services.

Marketing Opportunities and Strategies

For brands, WeChat offers multiple advertising options for engaging with its strong user base, including official accounts, mini – programs, WeChat Channels and WeChat Moments ads. These tools enable businesses to connect effectively with target customers across both 1st-tier cities and lower-tier cities alike.

2. Weibo (or Sina Weibo)

Overview

Often referred to as China’s version of Twitter, Weibo is a leading microblogging platform with over 600 million monthly users. Accessible primarily through mobile phones, it’s particularly popular for sharing news, trending topics, and social buzz that captures moments from users’ daily life and keeps them engaged with viral content.

User Demographics and Statistics

Weibo’s user base skews younger, with the majority of users falling between the ages of 18-30. About 56% of users are male and 44% are female.Users spend an average of 30-45 minutes per day on the platform, using it to stay up to date on the latest news, celebrity gossip, and societal discussions.

Weibo is particularly popular in 1st and 2nd-tier cities, though it is gaining traction in 3rd-tier cities as well. The platform’s appeal lies in its open, public format, where users can share posts, comment on trends, and interact with influencers (KOLs).

Marketing Opportunities and Strategies

Brands looking to reach a larger audience or launch social media marketing campaigns often turn to Weibo for its ability to generate buzz quickly. With effective use of hashtags, sponsored posts, and influencer collaborations, brands can take advantage of the platform’s virality to build awareness. For example, several fashion brands have seen success by partnering with Chinese celebrities to promote new collections through interactive Weibo posts.

3. Xiaohongshu (Little Red Book)

Overview

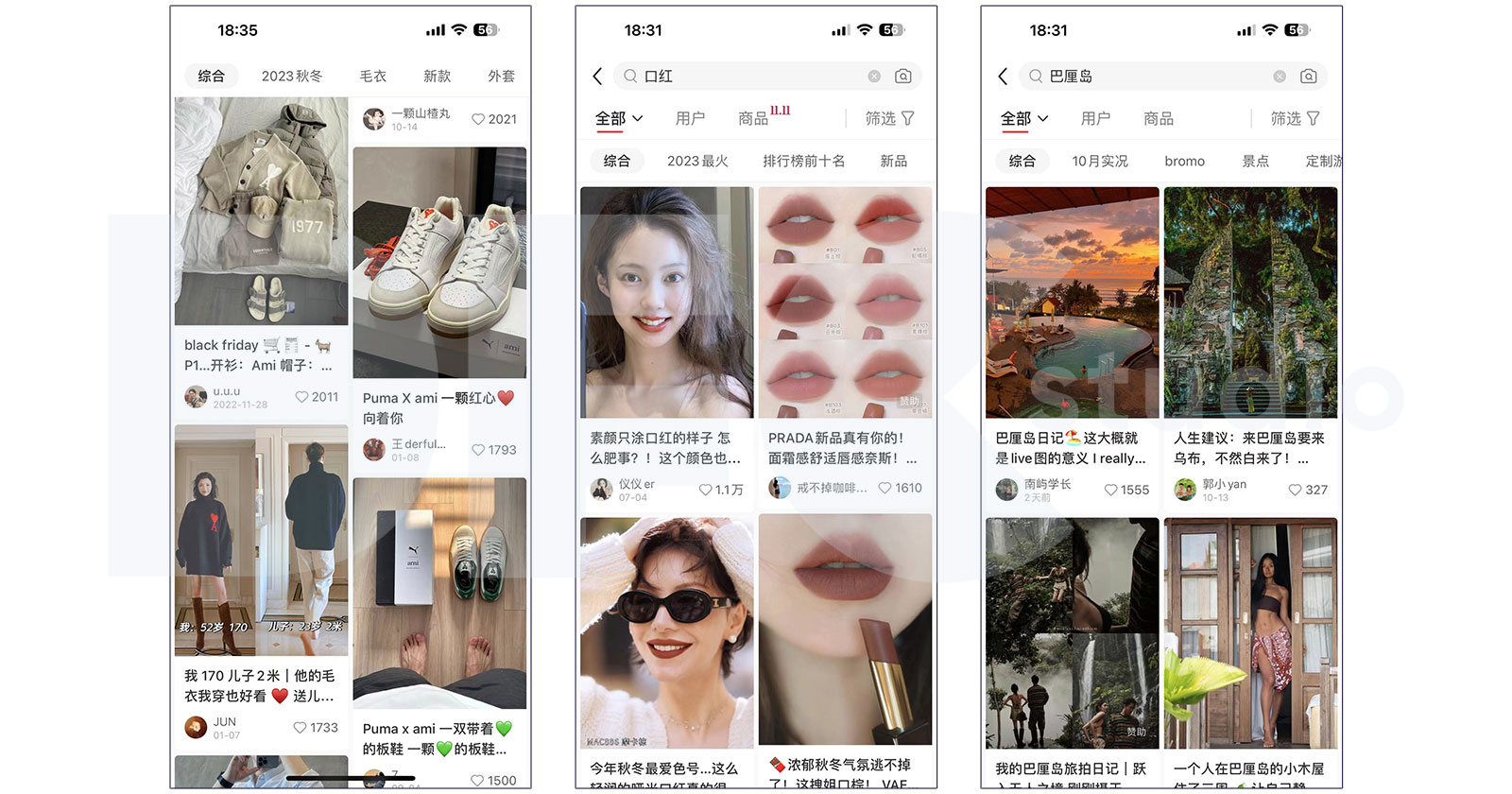

Xiaohongshu, China’s Instagram-like social media platform, boasts over 260 million monthly active users (MAU), with each user spending approximately 40 minutes daily exploring user-generated content such as product reviews, tutorials, and lifestyle tips.

The platform’s unique blend of e-commerce platform features and social media functions, including official accounts and an active online community, makes it highly effective for content marketing, enabling brands to directly engage with potential customers and drive product promotion and sales.

User Demographics and Statistics

Popular among young urban women, especially in first-tier cities and 2nd-tier cities, Xiaohongshu caters to users interested in beauty, fashion, lifestyle, and travel. About 70% of its users are women aged 18 to 35, with many coming from affluent backgrounds, eager to discover and purchase high-quality, trendy products.

Marketing Opportunities and Strategies

Xiaohongshu is renowned for its user-generated content, where individuals share authentic product reviews and recommendations. Brands that collaborate with KOLs or KOCs on the platform can reach an engaged, educated target audience that values authenticity and peer advice. This makes Xiaohongshu a key player for brands looking to create meaningful connections through influencer partnerships, product listings, and interactive content.

4. Douyin

Overview

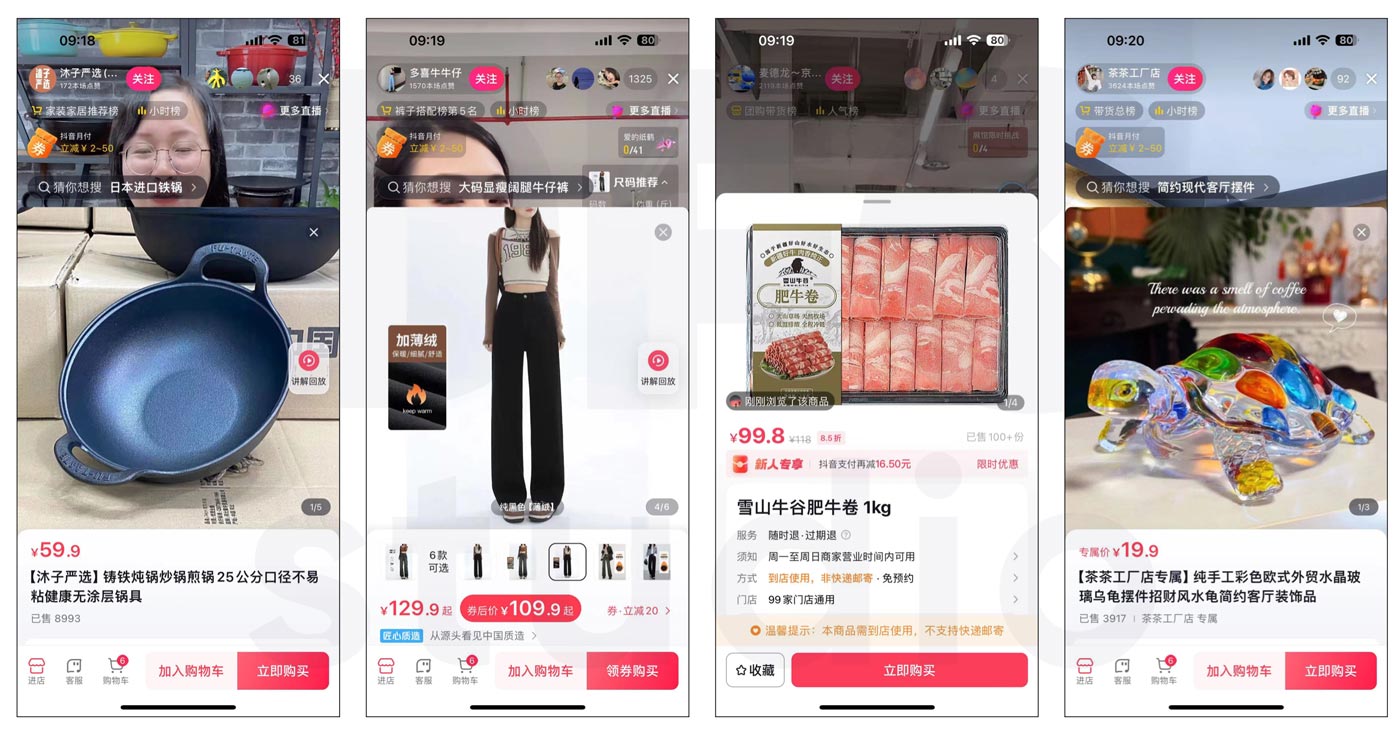

Douyin, the Chinese version of TikTok, is a leading short-form video platform with over 730 million monthly active users (MAU). Users spend an impressive 88 minutes per day on average, engaging with a vast array of algorithm-driven content that spans entertainment, education, and product promotions.

User Demographics and Statistics

Douyin’s audience is predominantly made up of young mobile users, with around 80% of users under the age of 35. The largest user demographic is aged 16-24, reflecting its strong appeal to Gen Z.

In terms of gender, the platform has a fairly balanced split, with 55% female and 45% male users. Douyin is particularly popular in first-tier cities and second-tier cities, but it has also made significant inroads into third-tier cities and smaller regions.

Marketing Opportunities and Strategies

Douyin’s seamless integration of social media marketing and e-commerce allows users to make purchases directly through the app, making it essential for brands looking to increase sales via mobile payments. It effectively promotes lifestyle products and everyday items through short, creative videos that fit into users’ everyday life.

Known for its dynamic and engaging content, Douyin serves as a hub for influencer marketing and live streaming events. Its powerful algorithm enables brands to reach larger audiences with visually captivating content that resonates across demographics.

5. Kuaishou

Overview

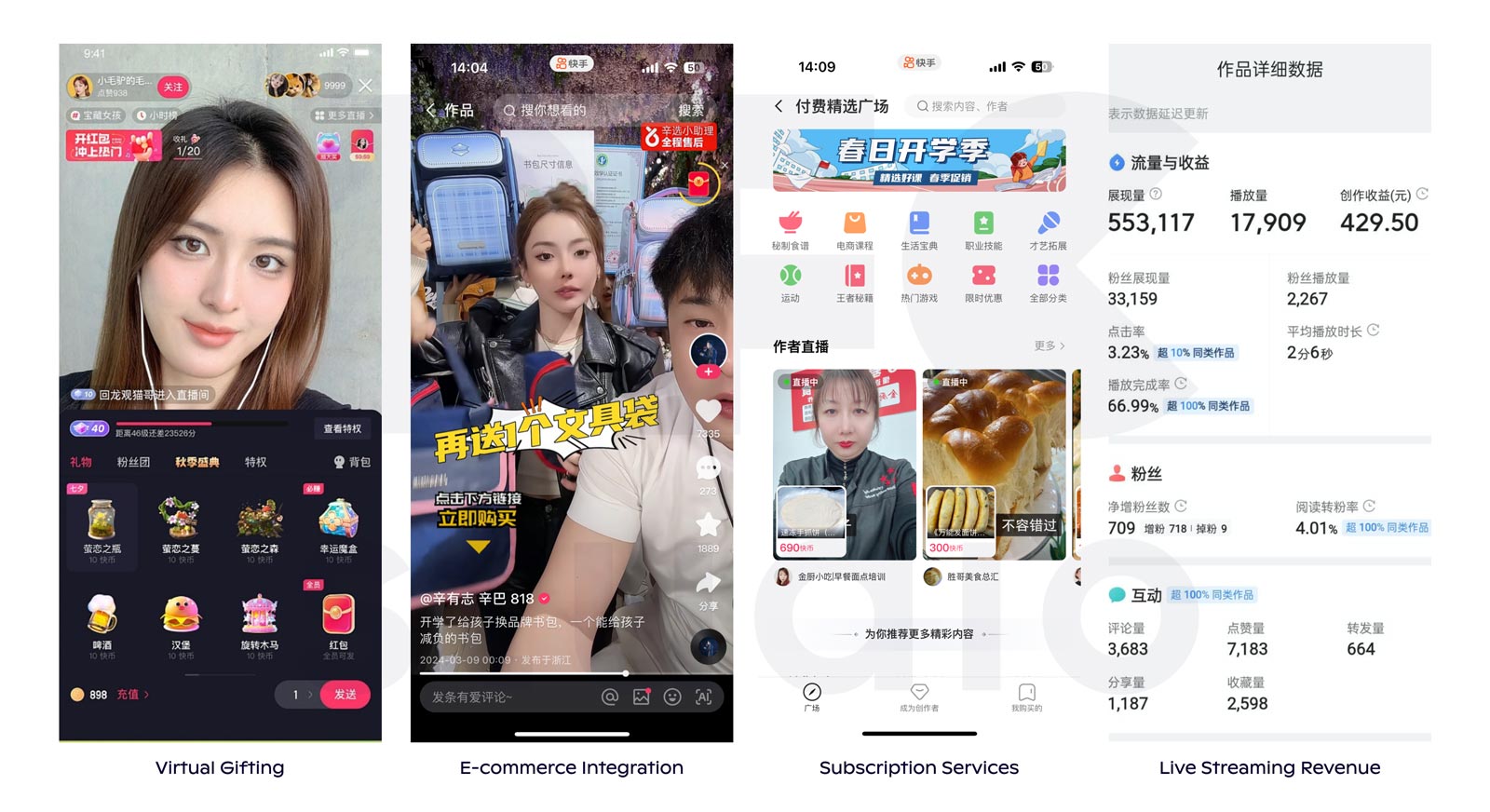

Kuaishou, with over 600 million monthly active users (MAU), is another major short-form video platform in China. Users spend an average of 85 minutes per day on the platform, engaging with a wide range of content, from personal vlogs to product demonstrations and e-commerce live streams.

While it shares similarities with Douyin, Kuaishou is especially popular in lower-tier cities and rural areas. Its user base tends to be more geographically diverse, with a focus on communities outside the major urban centers.

User Demographics and Statistics

The platform attracts a slightly older audience than Douyin, with a large proportion of users between ages 25-45. The gender split is fairly even, with 52% male and 48% female users.

Kuaishou has become a go-to platform for brands targeting lower-tier city consumers, particularly in 3rd and 4th-tier cities.

Marketing Opportunities and Strategies

Its audience is more community-focused, valuing interpersonal connections and trust over celebrity endorsements. This makes the platform ideal for social media marketing strategies centered on local influencers and everyday life scenarios. Brands can leverage Kuaishou’s deep engagement with its users by participating in live streaming events or collaborating with KOLs and KOCs who have strong ties to their communities.

6. QQ

Overview

Launched by Tencent in 1999, QQ is one of China’s longest-standing and most iconic social platforms. Originally starting as an instant messaging app, QQ has evolved into a comprehensive social media and entertainment platform, offering a wide range of features including messaging, gaming, online communities, music streaming, and mobile payments.

While WeChat has overtaken QQ as the dominant social app in China, QQ still maintains a strong user base, particularly among younger audiences and users in China’s lower-tier cities. QQ’s versatility in offering both desktop and mobile versions continues to make it a popular choice for communication and entertainment.

User Demographics and Statistics

As of 2024, QQ continues to have a significant user base, with over 600 million monthly active users (MAU). A large portion of QQ’s user demographic is made up of younger users, particularly teens and young adults, ranging from ages 12 to 29. These users are drawn to QQ’s features such as online gaming, virtual avatars, and community groups, which foster social interaction and entertainment.

Additionally, QQ is particularly popular in 2nd and 3rd-tier cities, as well as lower-tier cities, where it continues to thrive among users who prefer its desktop functionality and wide range of entertainment options. The platform also has a slightly more male-dominated audience, with approximately 55% of users being male. While QQ’s user base has shifted over time, it remains a key social platform for youth and gaming enthusiasts, maintaining its role as a major player in China’s digital ecosystem.

7. Zhihu

Overview

Zhihu, often compared to Quora, is China’s leading professional networking platform and knowledge-sharing community, attracting an educated target audience with a keen interest in in-depth discussions and expert opinions.

With over 200 million registered users, the platform offers a space where social media users can seek advice, share insights, and engage in high-quality content across a wide range of topics, from technology and business to lifestyle and education.

User Demographics and Statistics

Zhihu’s user base consists mainly of professionals, university students, and intellectuals from 1st and 2nd-tier cities, making it ideal for brands looking to establish credibility and connect with a more sophisticated audience.

The user demographic is primarily young adults, with around 60% of users aged between 18-34. Approximately 58% of users are male and 42% are female.

Users spend an average of 35-50 minutes per day on the platform, consuming detailed content that provides value beyond entertainment—such as expert answers, case studies, and thought leadership articles.

Marketing Opportunities and Strategies

As a professional networking platform, Zhihu provides brands the unique opportunity to engage with a discerning and educated target audience. This makes it ideal for promoting products that require deeper understanding or appeal to niche markets. By participating in discussions or creating branded content, brands can position themselves as industry experts and build trust.

Zhihu’s community-driven model fosters genuine peer recommendations, making it a powerful tool for word-of-mouth marketing. While less focused on e-commerce than platforms like Douyin, Zhihu effectively engages social media users seeking trustworthy information and thoughtful discussions.

8. Douban

Overview

Douban, founded in 2005, is a unique social media platform in China that focuses on cultural content such as movies, books, music, and events. Unlike many other social platforms, Douban is known for its thoughtful, intellectual community, where users come together to discuss and review cultural products.

User Demographics and Statistics

As of 2024, Douban has a smaller but highly engaged user base, with around 200 million registered users and approximately 60 million monthly active users (MAU). The platform attracts an educated target audience, with the majority of its users being college graduates or university students.

Its users are typically between the ages of 20 and 35, with a significant number of them residing in 1st and 2nd-tier cities. Douban also has a strong appeal among female users, who make up around 60% of the platform’s audience.

Marketing Opportunities and Strategies

Douban users are known for their interest in intellectual and creative discussions, with many engaging deeply in reviews and critiques of films, literature, and music. This makes it an ideal platform for brands looking to target culturally discerning consumers who value authenticity and quality over mass appeal.

While Douban’s user base is more niche compared to other Chinese social platforms, it offers unique content marketing opportunities for brands that wish to engage with a thoughtful, culturally sophisticated audience.

9. NetEase Cloud Music

Overview

NetEase Cloud Music is one of China’s most popular music streaming platforms, known for its extensive library of songs, podcasts, and user-generated playlists. Launched in 2013, the platform distinguishes itself with a strong social component, where users can leave comments on songs and connect through shared musical tastes.

User Demographics and Statistics

As of 2024, NetEase Cloud Music has over 200 million monthly active users, with a significant following among young, urban listeners who seek a personalized and interactive music experience.

Marketing Opportunities and Strategies

The platform appeals to a highly engaged, music-focused community and serves as an effective channel for brands looking to connect with creative, socially active audiences through sponsored playlists, ads, and artist collaborations.

China’s e-commerce market is the largest in the world, driven by highly competitive platforms like Taobao, JD.com, and Pinduoduo. Each of these platforms has carved out a unique niche in the market, offering brands and consumers different features, shopping experiences, and product ranges.

10. Taobao

Launched by Alibaba in 2003, Taobao is China’s leading C2C e-commerce platform, connecting individuals and small businesses directly with consumers. Known for its wide range of products, from everyday items to niche goods, Taobao provides a personalized shopping experience powered by advanced algorithms and social media marketing features like live streaming and customer reviews. The platform’s integration with Alipay ensures secure mobile payments, further simplifying the shopping process.

With over 900 million monthly active users in 2024, Taobao appeals widely to younger users in 1st and 2nd-tier cities but is rapidly growing in lower-tier markets as well. Predominantly used by women, Taobao’s mobile app sees 80% of its transactions from mobile users, highlighting the platform’s importance in Chinese consumers’ everyday life and its reach to larger audiences across China.

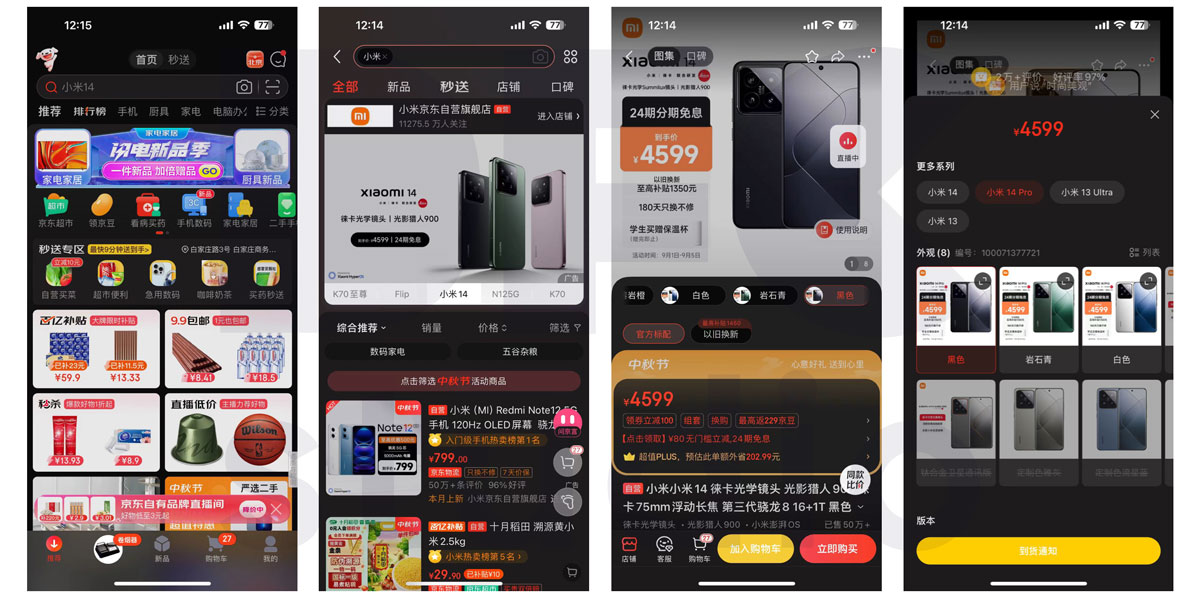

11. JD.com

JD.com, founded in 1998, is one of China’s largest and most prominent B2C e-commerce platforms, known for its commitment to authenticity and quality. The platform offers a vast array of products, including electronics, fashion, and household items, making it a go-to destination for online shoppers. JD.com distinguishes itself through its extensive logistics network, allowing for same-day and next-day delivery in many areas, which enhances the customer experience.

With over 500 million active users as of 2024, JD.com attracts a diverse audience, with a significant portion of its customer base residing in 1st and 2nd-tier cities. The platform emphasizes mobile shopping, with a large share of transactions conducted via its app.

Additionally, JD.com has made significant strides in integrating social media marketing, partnering with influencers and utilizing content to engage consumers effectively. This combination of reliability, convenience, and innovative marketing strategies positions JD.com as a leader in China’s e-commerce landscape.

12. Pinduoduo

Pinduoduo, launched in 2015, is a rapidly growing social commerce platform that has transformed the way consumers shop online in China. Combining e-commerce with social interaction, Pinduoduo encourages users to participate in group buying, allowing them to purchase products at significantly reduced prices by teaming up with friends or family. This unique model has attracted a vast user base, making Pinduoduo one of the top e-commerce platforms in China.

As of 2024, Pinduoduo boasts over 900 million active users, with a strong presence in lower-tier cities where price sensitivity is high. The platform primarily targets price-conscious consumers, offering a wide range of products, from groceries to household goods. Its engaging features, such as interactive games and promotions, enhance user experience and foster a sense of community. Pinduoduo’s innovative approach to social media marketing and its emphasis on affordability have made it a formidable player in China’s e-commerce ecosystem.

China’s top video streaming platforms offer a wide range of longer-form video content that appeals to diverse audiences, providing everything from user-generated videos to professional series and live events, and playing a key role in shaping online entertainment.

13. Bilibili

Bilibili (or B zhan) is a popular Chinese video streaming platform known for its focus on anime, gaming, and youth culture content. Originally launched for anime fans, it has since expanded to include a diverse range of content, from documentaries to live streams.

Bilibili attracts a younger audience, with over 86% of users under 35, and boasts a highly engaged community of over 330 million monthly active users and 400 million registered users. This makes it ideal for brands targeting tech-savvy, youthful audiences in China.

14. Tencent Video

Tencent Video is one of China’s leading video streaming platforms, offering a vast library of dramas, movies, variety shows, and exclusive content. With over 120 million paying subscribers and 900 million monthly active users, Tencent Video is popular across multiple demographics, including families and younger viewers.

Known for its high-quality, longer-form video content, the platform is particularly strong in original productions and partnerships with global studios, making it a key player for brands aiming to reach large, diverse audiences in China.

15. iQiyi

iQiyi is a major Chinese video streaming platform, often referred to as the “Netflix of China,” known for its extensive selection of original series, movies, and variety shows. With over 500 million monthly active users and 100 million paid subscribers, iQiyi appeals to a broad audience across different age groups, with a strong following among younger viewers.

The platform is renowned for its high-quality productions and exclusive content partnerships, attracting viewers with popular genres like dramas, reality shows, and animated series. iQiyi’s integration of interactive features and social elements enhances viewer engagement, making it an ideal platform for brands to connect with highly invested audiences across China.

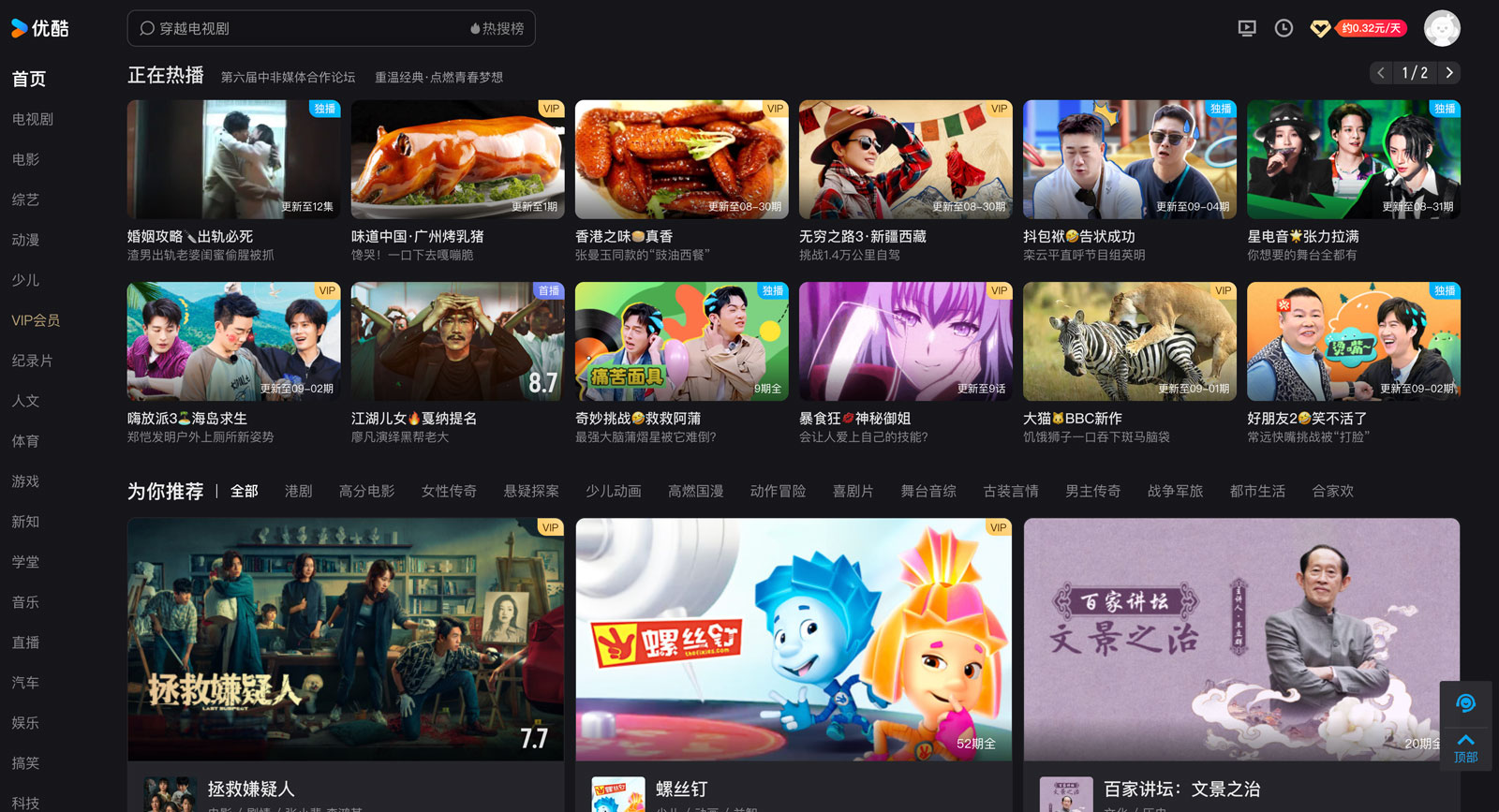

16. Youku

Youku, one of China’s longest-standing video streaming platforms, offers a broad array of movies, TV dramas, variety shows, and user-generated content. Often compared to YouTube, Youku appeals to a diverse audience with content that spans multiple genres and demographics.

As of 2024, Youku has over 500 million monthly active users, with a strong presence in both urban and lower-tier cities. Known for its partnerships with prominent studios and its rich catalog of long-form videos, Youku provides brands with access to large, diverse audiences in China’s growing digital landscape, particularly through ad placements and sponsorships in popular shows.

Conclusion

China’s social media landscape is vast and dynamic, offering brands a unique opportunity to engage millions of Chinese users across various social media channels. Platforms like WeChat, Weibo, Xiaohongshu, and Douyin cater to diverse audiences, including urban professionals and lower-tier city consumers. With e-commerce integration and the reach of streaming service platforms, brands can implement targeted digital marketing strategies that resonate across demographics. As the landscape evolves, adapting to trends like online video and interactive content will be essential for reaching future generations within China’s vibrant social media ecosystem.

Want to Succeed in China? Download Our Free 84-Page Strategic Guide

Want to Succeed in China? Download Our Free 84-Page Strategic Guide

Keep up with the latest trends

DFC Studio is a Beijing-based digital marketing and e-commerce agency specialized in the Chinese market.

From strategizing your market entry to fostering brand recognition, our mission is to facilitate your expansion in order to boost your sales.

What sets us apart is our team of highly accomplished professionals, all of whom are graduates from renowned international universities.

This unique blend of bicultural expertise and deep understanding of the Chinese market positions us as a great partner to unlock your brand’s full potential in this thriving landscape.