All you need to know about Live-streaming E-commerce in China

Live-streaming e-commerce has emerged as a dynamic and transformative force within the realm of online shopping, revolutionizing the traditional e-commerce landscape.

This multifaceted phenomenon encompasses a series of interconnected elements, each contributing to its widespread adoption and success.

From understanding the reasons behind its rise to dissecting the user demographics and dissecting the product logic employed, we aim to provide a comprehensive overview. As we navigate through these facets, feel free to contact us for more detailed strategic information.

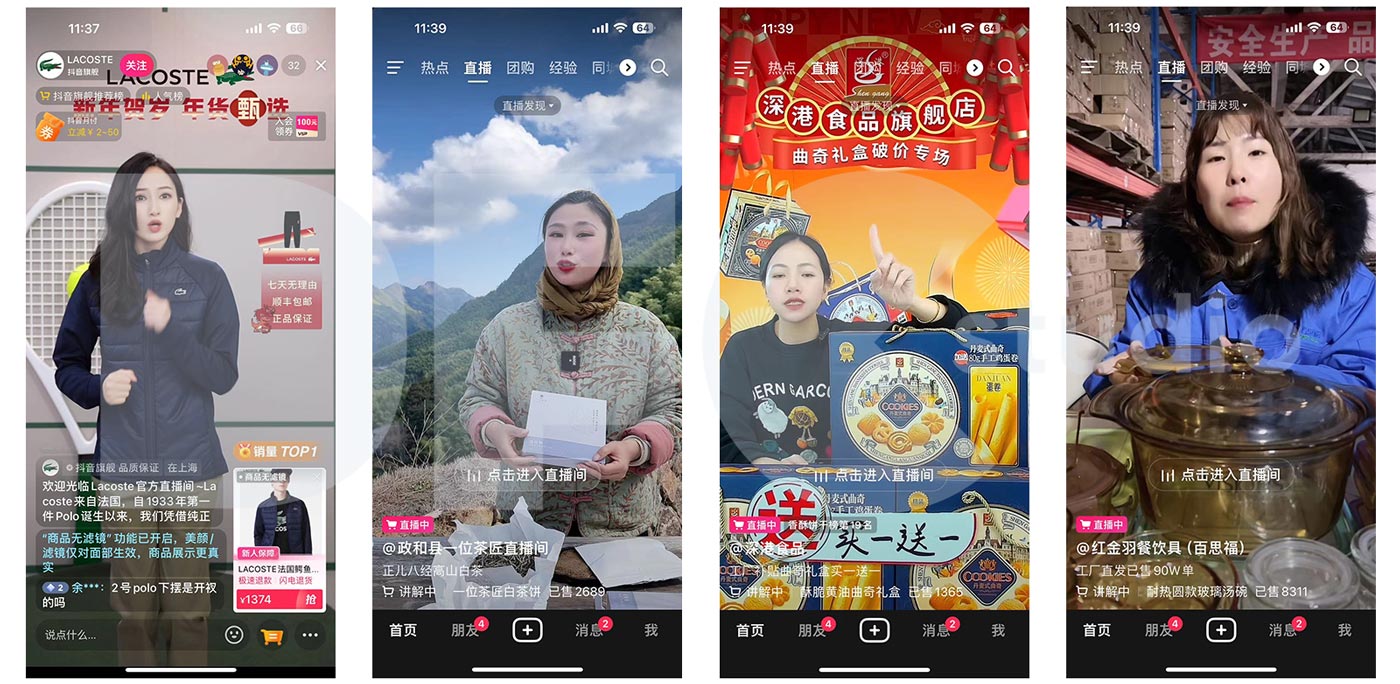

What is live-streaming E-commerce ?

Live-streaming e-commerce or livestream shopping is essentially setting up a virtual stall to sell goods on e-commerce social platforms. Some use Key Opinion Leaders (KOLs) for better influence, while others choose to self-broadcast.

One major feature is the integration of promotional and sales channels. Traditional TV shopping also has this feature, but it cannot provide real-time interactions such as comments, feedback, and collect viewer data for shopping behavior and repurchase rate analysis like live streaming e-commerce.

The reasons behind live-streaming E-commerce

As an industry that has only been around for 6 years, live-streaming e-commerce is experiencing astonishing growth at an incredible pace in the Chinese Market, with transaction volumes repeatedly reaching new highs.

In 2022, the live-streaming e-commerce businesses on main social media platforms such as Douyin, Kuaishou, and Taobao Live experienced rapid development, further increasing the market concentration of China’s live-streaming e-commerce industry compared to 2020, maintaining at a high level, with a CR3 (Concentration Ratio of the top 3 companies) of 88%, and the remaining companies holding less than 12% of the live-streaming e-commerce market share.

Currently, the dominant players in the Chinese live streaming e-commerce industry are among three platforms: Douyin, Kuaishou, and Taobao Live, with other platforms such as JD, Mogu Street, and Xiaohongshu holding relatively small market shares.

Douyin and Kuaishou only started laying out their live streaming e-commerce business in 2018, with a small market share in 2018-2019, but rapidly gained a significant market share over these years.

According to statistics from the E-commerce Research Center of NetEase, the transaction volumes in the domestic live-streaming e-commerce market from 2017 to 2021 were 19.64 billion yuan (2017), 135.41 billion yuan (2018), 443.75 billion yuan (2019), 1,285 billion yuan (2020), and 2,361.51 billion yuan (2021), respectively.

Notably, the transaction volume of the live-streaming e-commerce market in 2018 saw a remarkable growth rate of 589.46%, with growth rates in 2019 and 2020 reaching 227.7% and 136.61%, respectively.

User analysis on live-streaming E-commerce audience

With over 900 million internet users, China offers immense opportunities for businesses and content creators with social media and online video platforms to engage with a large audience and promote their products or services.

Weibo, Bilibili, and Xiaohongshu have achieved strong penetration in developed first and second-tier cities, driving a significant proportion of high-spending consumers. Meanwhile, Kuaishou primarily attracts users from third-tier cities and below.

Looking at user profiles, each platform attracts a group of young individuals with new expressions and attitudes. On Douyin, the user base is relatively evenly distributed among individuals aged 25-50. Kuaishou has a prominent core group of users, and Xiaohongshu shares similarities with Weibo, where individuals under 35 years old constitute the main user base. Bilibili can be described as “growing together with users,” making the 25-35 age group a significant portion of its user base.

Over the past year, all 4 platforms have achieved varying degrees of scale growth. Among them, Xiaohongshu experienced the fastest growth, which is somewhat related to its scale.

Looking at city tiers, with the orderly recovery of production and life, the overall population is “moving upward.” First and second-tier developed cities are the “main battlegrounds” for all platforms, providing more possibilities for commercialization.

It’s worth noting that Kuaishou’s efforts in the high-spending consumer group are showing initial effectiveness. According to QuestMobile data, the user base of Kuaishou with a monthly online consumption capacity of 3000 yuan or more has grown by 8.0% year-on-year.

The silver-haired E-commerce market

The new generation of elderly individuals is gradually getting accustomed to online content and product consumption. According to the “2022 Silver Economy Insight Report” released by QuestMobile, in August 2022, the monthly active scale of silver-haired internet users reached 297 million, a year-on-year growth of 12.5%. The average monthly usage time per person was 121.6 hours, showing an 8.6% year-on-year increase, a growth rate significantly higher than the overall average.

This generation of “silver-haired” individuals is increasingly trusting the internet and is willing to make online purchases. As of August 2022, the online consumption capacity of the silver-haired demographic, with an expenditure of 1000 yuan or more, and the active user base with high consumption intentions were 198 million and 205 million, respectively, marking year-on-year growth of 10.6% and 10.2%.

Additionally, the report found that the new generation of active and lively silver-haired individuals show a two-tiered trend in purchasing behavior within livestream commerce. On one hand, they are enthusiastic about everyday items, clothing, personal care, and household cleaning products, which are popular low-cost consumer goods. On the other hand, they have a particular fondness for products such as jewellery, collectables, and health supplements.

Many brands targeting the middle-aged and elderly market have seized the opportunity in livestream e-commerce to tap into the silver-haired e-commerce market.

In summary, live-streaming e-commerce satisfies the needs of middle-aged and elderly Chinese people to “amuse themselves” interestingly while completing “useful” shopping. For brands, live-streaming e-commerce might be the most effective shortcut to enter the realm of the silver economy.

Product logic in live-streaming E-commerce

Category

Coexistence of Mainstream and Niche: Generally speaking, the primary product categories in live-streaming e-commerce are currently concentrated in the mainstream consumer goods sector.

At present, the best-selling product categories in e-commerce live-streaming generally present themselves in three tiers.

The first tier includes clothing, daily necessities, gourmet food, and beauty products. The second tier includes home appliances, gaming products, books, and stationery. The third tier includes virtual products or services, jewellery, and more. Among them, clothing is the top-selling category on Douyin’s e-commerce platform and holds overwhelming advantages.

From a growth perspective, the report finds that the concentration of sales for the top 4 advantageous categories on Douyin is decreasing. This implies that the product categories in Douyin’s live-streaming e-commerce are becoming more diverse.

Notably, the categories with the highest growth in sales include pet supplies, furniture and building materials, and pharmaceuticals and health products. Looking at the growth in the number of brands with sales, pharmaceuticals and health products, 3C electronics, furniture and building materials, and jewellery have the highest increases.

This indicates the robust inclusiveness of e-commerce livestreaming towards product categories. It is believed that in the future, niche industries are highly likely to become the primary driving force for the growth of live-streaming e-commerce.

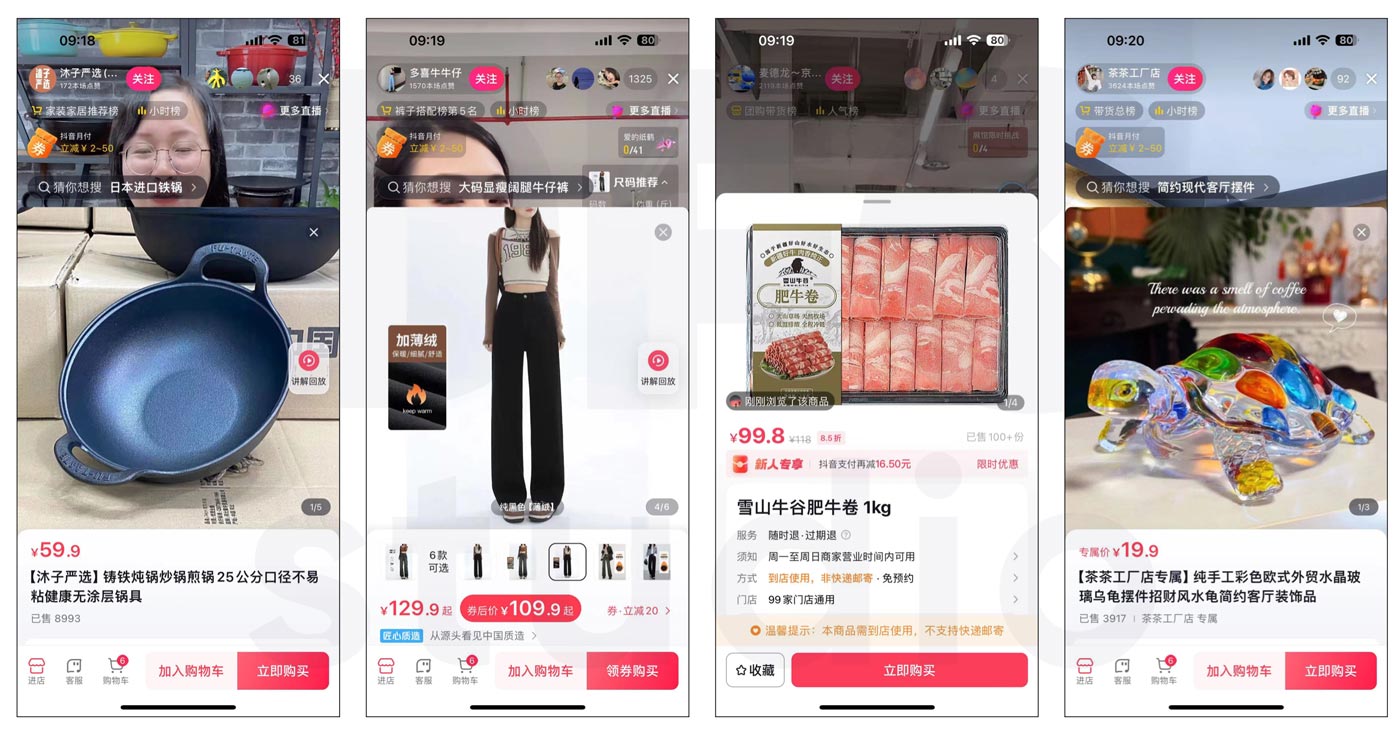

Price

The report reveals that in 2022, the average spending per transaction for Chinese e-commerce live-streaming users is concentrated between 100-500 yuan. Within this range, products priced below 100 yuan are the most popular on the Douyin platform, accounting for 60% of sales.

However, simultaneously in terms of growth, there is also a relatively large increase in the sales of products priced between 700-1000 yuan on Douyin. From the observed trends in category growth mentioned above, it can be inferred that market gaps in relatively high-priced segments, such as kitchen and bathroom appliances, furniture, and building materials, are gradually filling.

With the continuous standardization of the live-streaming e-commerce market, the application of technology in the live-streaming field, and the ongoing development trend of quality driving out inferior products in the context of intensified competition, users are increasingly trusting live-streaming e-commerce platforms and this media format.

The decision-making chain for high-priced products will be significantly shortened. It is believed that in the near future, live-streaming sales of cars, houses, and auctions will become increasingly commonplace.

Brand

Live-streaming E-commerce is not only the domain of big brands but also a carnival for “white-label” products.

Leveraging the advantages of livestreaming e-commerce in content penetration, efficient trust building, precise traffic distribution, user engagement, and conversion, “white-label” products without strong brand endorsements are quickly rising in the relatively “egalitarian” field of live-streaming e-commerce among Chinese consumers.

These relatively “aggressive” “white-label” players, compared to mature brands, are more willing to invest heavily in what they consider to be the highest-return new methods, new ways, and new media.

Data found that the paths of “white-label” rise on Douyin and Kuaishou are distinctly different. Douyin brands emphasize content, usually using short video personas as an entry point, focusing on building an original fan base and controlling the duration and frequency of live-streams.

On the other hand, Kuaishou brands place more emphasis on sales, often having a mature and extensive network of anchors, adopting strategies like explosive products and non-stop live-streams, and paying attention to live-streaming skills and compelling sales tactics focused on conversion rate.

While “white-label” products shine in the field of live-streaming e-commerce, data suggests that for long-term sustainability, they need to focus on building quality and brand reputation.

The report finds that live-streaming e-commerce users are gradually diversifying their attention to products, increasingly caring about the cost-effectiveness of products while also valuing brand endorsements and quality assurance.

The future of live-streaming E-commerce

Live-streaming E-commerce going global

Benefiting from the rapid development and first-mover advantage of live-streaming e-commerce in China, along with various advantages in industrial manufacturing, internet technology, logistics systems, and the impact of the pandemic, globalization and online trading of products have broken spatial constraints. A massive number of goods are now connected to global consumers through live-streaming e-commerce.

32% of global consumers indicate that they have developed a habit of shifting from offline to online shopping during the pandemic, while 43% state that they would engage in more online shopping if the situation persists.

Online shopping has become a new norm for overseas consumers, leading to significant incremental growth in cross-border e-commerce. By 2025, the market size of cross-border e-commerce live-streaming is expected to exceed 8 trillion yuan, developing rapidly with an increase of around 60%.

Internet companies like Douyin and Kuaishou are also making concerted efforts to expand into cross-border live-streaming e-commerce. Leveraging their domestic experience in live-streaming product promotion, they replicate this model in cross-border e-commerce, facilitating bidirectional shipments between domestic and overseas markets.

Virtual reality E-commerce

In the near future, driven by technologies such as 5G, AR, and VR, virtual e-commerce is poised to enter a period of development dividends. Digital virtual personalities may gradually replace human anchors, achieving truly 24/7 live-streaming shopping with lower risks. The intelligent manufacturing of products and the continuous automation of the supply chain will promote more efficient circulation of goods in live-streaming e-commerce. Moreover, live-streaming environments will move towards low-latency, more immersive, and real-time rendering interactive user experiences.

Platforms, brands, and users are eagerly participating in this technological revolution.

From the platform perspective, in recent years, internet companies such as Taobao, Tmall, JD.com, Kuaishou, and ByteDance have successively introduced virtual anchors, sparking a trademark registration war for virtual anchors. Taobao has stated that virtual anchors and 3D scenes have become an important focus for the platform.

From the brand perspective, many brands have chosen to use virtual personalities for live-streaming shopping. In June of last year, the cosmetics brand Huaxizi used a virtual spokesperson named “Huaxizi” for store live-streaming.

On the user side, the Generation Z demographic is gradually becoming the main force in consumption. Diverse content, visually appealing technology, and immersive virtual entertainment are more attractive to users, making the live-streaming shopping format featuring virtual brand IP images easily accepted.

The fusion of virtual and real in the form of “virtual + reality + interaction” in e-commerce is rapidly heating up. Virtual technology is bringing new creative experiences and rich application scenarios to live-streaming e-commerce. The e-commerce shopping experience is transforming the future marketing market.

Want to Succeed in China? Download Our Free 84-Page Strategic Guide

Want to Succeed in China? Download Our Free 84-Page Strategic Guide

Keep up with the latest trends

DFC Studio is a Beijing-based digital marketing and e-commerce agency specialized in the Chinese market.

From strategizing your market entry to fostering brand recognition, our mission is to facilitate your expansion in order to boost your sales.

What sets us apart is our team of highly accomplished professionals, all of whom are graduates from renowned international universities.

This unique blend of bicultural expertise and deep understanding of the Chinese market positions us as a great partner to unlock your brand’s full potential in this thriving landscape.