What is Douyin ? The Chinese TikTok – Complete guide (2025)

TikTok and Douyin are two short-video social platforms owned by the Chinese company ByteDance. Despite operating in different markets, they share a close relationship.

What is Douyin and what are the differences between Douyin vs TikTok?

The Origin of Douyin (TikTok)

TikTok and Douyin are two short video platforms owned by ByteDance. Despite operating in different markets with different groups of target audiences, considered as separate entities, they share a close relationship.

In 2016, the precursor to Douyin, an app named “Musical.ly” or “Music Short Videos,” was officially launched. Initially, it was a simple short video app where users could upload their music creations and share them with others. It quickly gained popularity and saw a rapid increase in user numbers.

In 2017, Douyin officially went live. It retained the basic functionalities of “Music Short Videos” while introducing more social interaction elements such as likes, comments, and sharing. Douyin became the first APP in China to start doing full-screen, as the time swiping became instinctive. These additions made Douyin more engaging and vibrant.

By 2018, Douyin began expanding into international markets. It first launched Douyin’s overseas edition and later introduced TikTok. TikTok became one of the most beloved apps globally.

In 2019, Douyin started intensifying its support and investment in content creators. It introduced the “Douyin Creator Program” to provide more exposure and incentives to outstanding content creators. Additionally, Douyin launched activities like “Douyin Live” and “Douyin Challenges,” attracting more users and creators.

In 2020, Douyin encountered new development opportunities. Amid the pandemic, Douyin introduced new features like “Douyin Live Commerce,” aiding businesses in online product promotion and sales. These features also provided users with more shopping choices and convenience.

Who Uses Douyin? Douyin User Statistics

On Douyin, 56.3% of users are male, while 43.3% are female. The majority of users based in mainland China fall into the age group of 25 and above, with a relatively high percentage having attained a bachelor’s degree. Around 55.4% of users reside in third-tier cities or above, and 29.2% are from fourth-tier to fifth-tier cities.

Why is Douyin So Popular?

Analysis can be done from four perspectives:

1. Visual Stimulation’s Directness

Videos can go viral instantly because our brains process visual stimuli faster and more directly than text, making images—and especially videos as sequences of images—more engaging, efficient, and appealing than long paragraphs of words.

2. Advantages of Short Videos

Short videos can go viral instantly because our brains process visual information faster and more directly than text, making short videos—sequences of engaging images—more efficient, stimulating, and appealing than long paragraphs of words.

3. Utilization of Fragmented Scene

People’s daily fragmented moments—like breaks, meals, commuting, or waiting—make short video the preferred content format, and platforms enhance this experience through both software features (e.g., hiding online status) and creative design (e.g., large subtitles, progress bars) to keep users engaged even in muted or casual viewing scenarios.

4. Contemporary Society Values Time Over Content

In the past, scarce quality content was valued, but in the internet era the real shortage is time; as Aldous Huxley warned, people grow attached to technologies that erode thinking, with the internet, search engines, and especially smartphones reshaping how our brains process and remember information.

5. Douyin algorithm

ByteDance’s advanced Douyin algorithm tracks user actions like clicks, likes, and comments to recommend personalized content, making short video the dominant format as it fits passive, carefree consumption, unlike long videos that require active choice.

How does Douyin work?

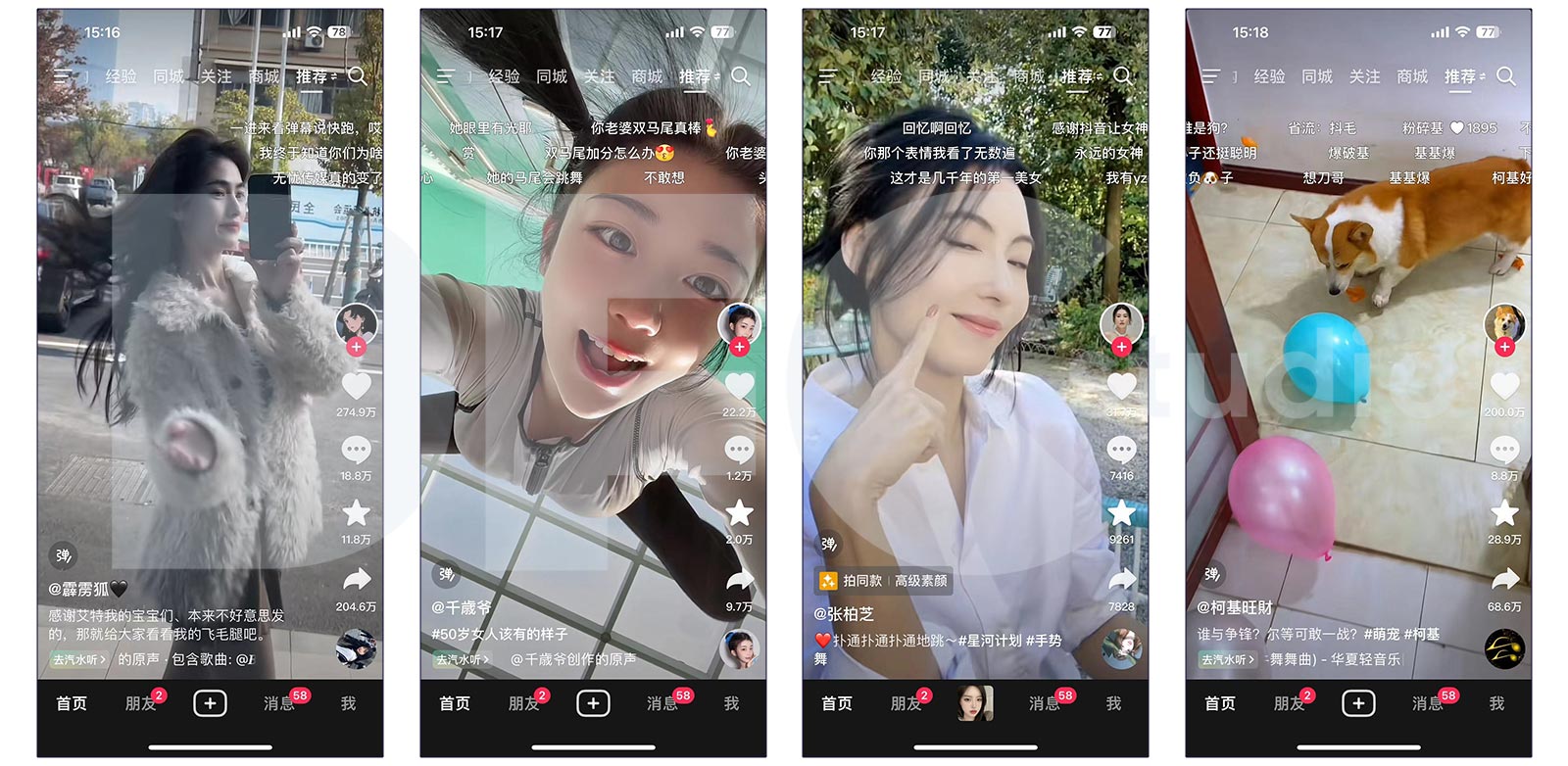

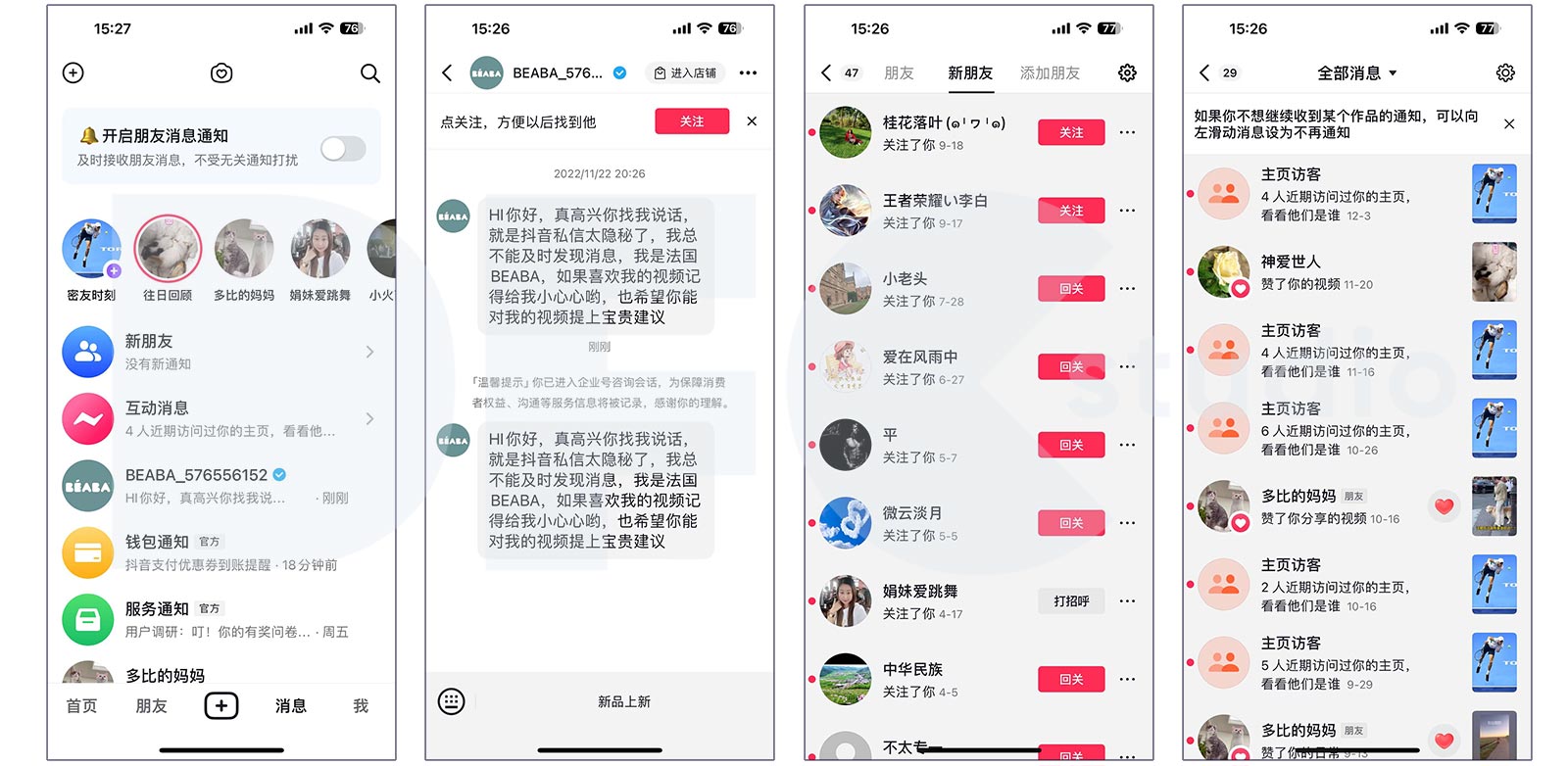

Douyin is quite user-friendly and offers various functionalities:

Home: It consists of search, marketing tools (such as Douyin pay or custom stickers or banner ads), followed accounts, recommended videos (video feed), and the live streaming section.

Nearby: This feature supports location-based switching for related local video feeds.

Video Creation Page: This page allows users to shoot videos, select music, edit content, and publish it.

Messages: This section contains interactions (such as receiving messages from e-commerce customer service), recommended accounts to follow, and message lists.

Search bar: The search feature allows any users to find the content related to what they are looking for.

Profile Page: It includes the user’s central area, basic information, profile editing, contacts, and a section for “Moments” (posts that can be set as public, private, or with a time limit), along with the display of the user’s videos on their profile.

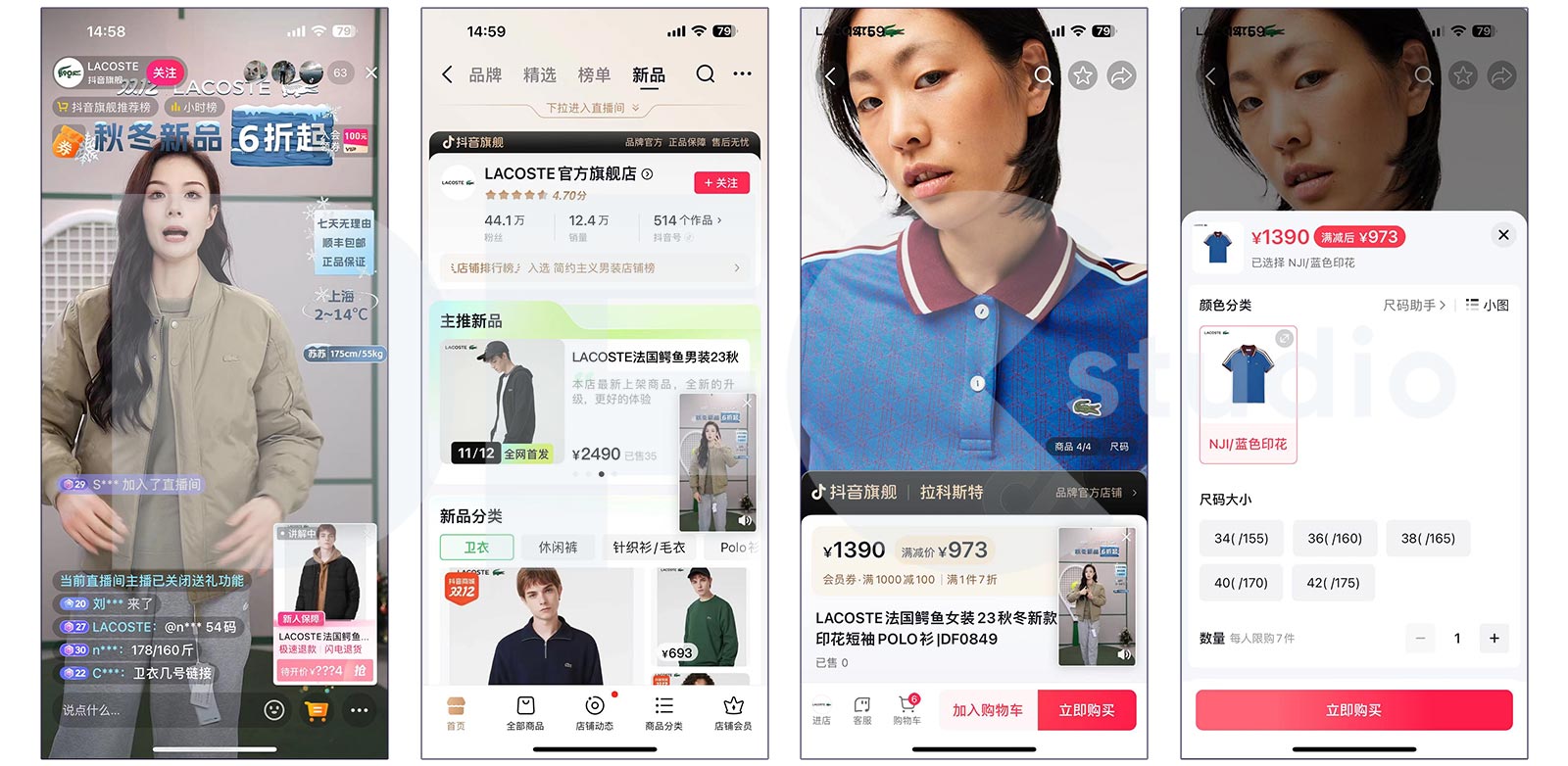

Douyin E-commerce Introduction and Analysis

As early as 2018, Douyin, with its vast user base, ventured into e-commerce, facilitating sales for third-party platforms like Taobao. In 2019, Douyin started constructing its own ‘Douyin Little Shops.’ By 2020, Douyin officially established its e-commerce department, challenging traditional shelf-based e-commerce.

In November of the same year, Douyin launched its first platform-level e-commerce event, the ‘Douyin Wonderful Goods Festival.’ During this event, which garnered over 10 billion live stream views, the total transaction volume surpassed 8 billion RMB measured by payment calculations.

By May 2022, Douyin placed the ‘Shopping Mall’ on its homepage and has recently launched the Douyin Supermarket service.

It took Alibaba 10 years, JD.com 13 years, and Pinduoduo nearly 5 years to achieve a GMV (Gross Merchandise Volume) of over one trillion RMB. Douyin, on the other hand, accomplished this milestone within just over two years of the establishment of its e-commerce department.

The trend of ‘short video e-commerce guidance’ has rapidly emerged across major platforms in the last five years as a prominent solution.

Among the three mainstream live e-commerce platforms (Diantao, Kuaishou, and Douyin), the types of anchors can be divided into three categories: influencers, brand-focused, and manufacturer-focused. Each mode has its own core advantages, and the profit model is also influenced by the core advantages of the platform:

- Influencers (or key opinion leaders) rely on “commission + slot fees” for profit.

- Brands rely on “daily sales + repeat purchases” for profit.

- Manufacturers rely on “daily sales + distribution” for profit.

Among live e-commerce platforms, Diantao leads in sales volume, Douyin in daily active users, and Kuaishou in lower-tier market reach, with user perceptions shaping behavior: Diantao as shopping-focused, Kuaishou and Douyin as content-driven, and Douyin’s strength lying in high-quality content that supports brand exposure, image building, and repeat purchases.

The Rules and Mechanisms of the Douyin Platform

Currently, Douyin’s main revenue streams consist of three components: advertising, live streaming rewards sharing, and e-commerce commissions. Among these, advertising contributes the vast majority of the revenue. Due to its high-quality content, Douyin is more popular in second-tier cities and above. Higher penetration rates in these cities imply a stronger ability to acquire “high-income, high-purchasing-power” users.

Douyin attracts more brand advertising thanks to its user demographics and content quality, supported by a “funnel model” traffic system where content first receives basic exposure, then advances to larger traffic pools as key metrics like completion, interaction, conversion, and dwell time meet higher thresholds.

Content creators can also purchase traffic from the platform to boost content dissemination. However, the ultimate reach of content still depends on its inherent quality. In other words, good content quality can save a significant amount of marketing budget.

Douyin prioritizes content quality (70%) over social relationships (30%). This is why, while scrolling through Douyin, we see more content recommended by the platform compared to content from friends we’ve followed.

Content on Douyin has an exposure period of up to 90 days, and exceptionally successful works can extend this exposure period. This is why, while using Douyin, we often come across content from a certain content creator that was posted several months ago.

Douyin emphasizes content quality, leaning towards a ‘media’ dissemination attribute. As a comparison, Kuaishou prioritizes the frequency of creator submissions, leaning towards a ‘community’ dissemination attribute.

Analysis of Douyin’s E-commerce Business

Starting from Q3 of 2020, Douyin gradually began restricting external links, completing all transactions within its system. Douyin users also increasingly use (or attempt) the live streaming function.

We define ‘order conversion’ as the ultimate goal and deduce the entire process of live streaming sales backward from the outcome to the starting point:

As widely known, to achieve order conversion, the preceding step is always viewing the shopping cart or adding items to it. Viewing the shopping cart is the step before placing an order, and the shopping cart can be divided into ‘viewing in the live stream room’ and ‘short video product preview in the cart.’ Based on user behavior patterns, ‘viewing in the live stream room’ can further be categorized into ‘actively viewing in the live stream room’ and ‘clicking on product (explanatory) pop-ups.’

The key to live stream viewership is attracting traffic, as more exposure leads to more users entering the stream; traffic comes in two forms—organic, driven by high-quality content that earns platform recommendations, and acquired, actively generated by the streamer.

Users who actively enter live stream rooms through organic traffic can discover broadcasters through features like ‘local, follow, and live broadcasting plaza.’ Acquired traffic is primarily displayed through ‘live stream screen recommendations’ and ‘short video recommendations (flashing light prompts).’

Once a certain number of users enter the live stream room, whether they’re interested in the products or the broadcaster’s persona, the potential for conversion exists. At this point, the sales ability of the broadcaster becomes crucial.

Among current live streaming platforms, four types of products stand out: clothing, cosmetics, jewelry, and food & beverages. These share a common trait of higher profit margins, covering expenses such as traffic acquisition and team operations. Particularly, clothing sales performance is most prominent.

Comparing brand live streaming performance: Brands perform better on Douyin than on the entire internet. On Douyin, brand live streaming is more like a private domain showcase, allowing better presentation and explanation of their products.

If you have further questions about Douyin, for more solutions to your business on the platform, and in China. Please don’t hesitate to reach us.

Douyin Q&A

What does Douyin mean?

Douyin is the Chinese character written as “抖音”, read as 【dǒu yīn】 in pinyin, meaning “shaking sound” in a literal way.

Is Douyin and TikTok the same?

Douyin and TikTok are both from ByteDance, with a different attention of the users from various the market. Douyin, the Chinese version focuses Chinese market, while TikTok, the international version focuses on markets outside China.

Are you able to use Douyin outside China?

Yes, Douyin imposes no restrictions and can be used in any country. You can upload videos, but live streaming from overseas locations is not permitted.

How to download Douyin?

You can download Douyin from any App Store on Android such as the Google Play Store and on Apple Store. In China, Douyin is one of the most downloaded apps and is highlighted by any Chinese App Store

Can Western companies create official Douyin business accounts?

To be able to get the blue checkmark and pass the verification process, you need to use a domestic business license. Therefore to do so, you will need to fill out a verification form.

If you have further questions about Douyin, for more solutions to your business on the platform, and in China. Please don’t hesitate to reach us.

Want to Succeed in China? Download Our Free 84-Page Strategic Guide

Want to Succeed in China? Download Our Free 84-Page Strategic Guide

Keep up with the latest trends

DFC Studio is a Beijing-based digital marketing and e-commerce agency specialized in the Chinese market.

From strategizing your market entry to fostering brand recognition, our mission is to facilitate your expansion in order to boost your sales.

What sets us apart is our team of highly accomplished professionals, all of whom are graduates from renowned international universities.

This unique blend of bicultural expertise and deep understanding of the Chinese market positions us as a great partner to unlock your brand’s full potential in this thriving landscape.