China Coffee Market: Trends, Consumer Insights, and Growth Opportunities 2025

China’s coffee market is booming in 2025, projected to exceed RMB 369.3 billion. Budget chains dominate, middle-class demand rises, and supply chain efficiency drives success.

Walk through the streets of Shanghai, Beijing, or Chengdu, and the aroma of freshly roasted coffee beans fills the air. Whether it’s a small coffee shop tucked in a quiet lane or one of the many fast-growing coffee chains, coffee has become a familiar part of everyday life. For millions of young professionals and members of the middle class, that morning cup of coffee is no longer a luxury—it’s a ritual.

In 2025, China’s coffee market is expected to exceed RMB 369.3 billion (≈ USD 51.8 billion), up from RMB 313.3 billion in 2024. Yet the average person still drinks only 22.24 cups per year, a fraction of what consumers in mature markets enjoy. This gap signals huge potential for further coffee consumption growth, especially as tastes diversify and consumer preferences evolve.

Affordable prices—typically RMB 5–15 (USD 1–2) per cup—make coffee accessible to nearly everyone. But behind that simple cup lies a complex network of coffee production, processing methods, and smart supply chain management. Together, these forces are shaping one of the most dynamic and promising beverage markets in the world.

From Luxury Treat to Everyday Habit

The rise of China’s coffee culture has been led by a new generation of coffee chains that made good coffee accessible to all. Luckin Coffee now operates more than 26,000 stores, and Cotti Coffee follows closely with 15,000 outlets—both expanding deep into smaller cities and university campuses. Meanwhile, emerging brands like Xiaoka Coffee are growing over 60% per year, reflecting a surge in domestic entrepreneurship and consumer enthusiasm.

For years, coffee symbolized status or Western lifestyle. Now, it reflects convenience and individuality. The growing middle class sees coffee as an everyday pleasure that fits seamlessly into work, study, and social life. In cafes across China, people meet friends, hold business meetings, or study for exams—turning the coffee shop into a hub of modern urban culture.

Health and wellness trends also influence consumer preferences. Drinks like zero-fat lattes, fruit-infused coffees, and functional beverages packed with vitamins or collagen are gaining traction. Meanwhile, specialty coffee—featuring single-origin coffee beans, light roasting, and artisanal brewing—caters to younger, more discerning coffee lovers seeking authenticity and flavor storytelling.

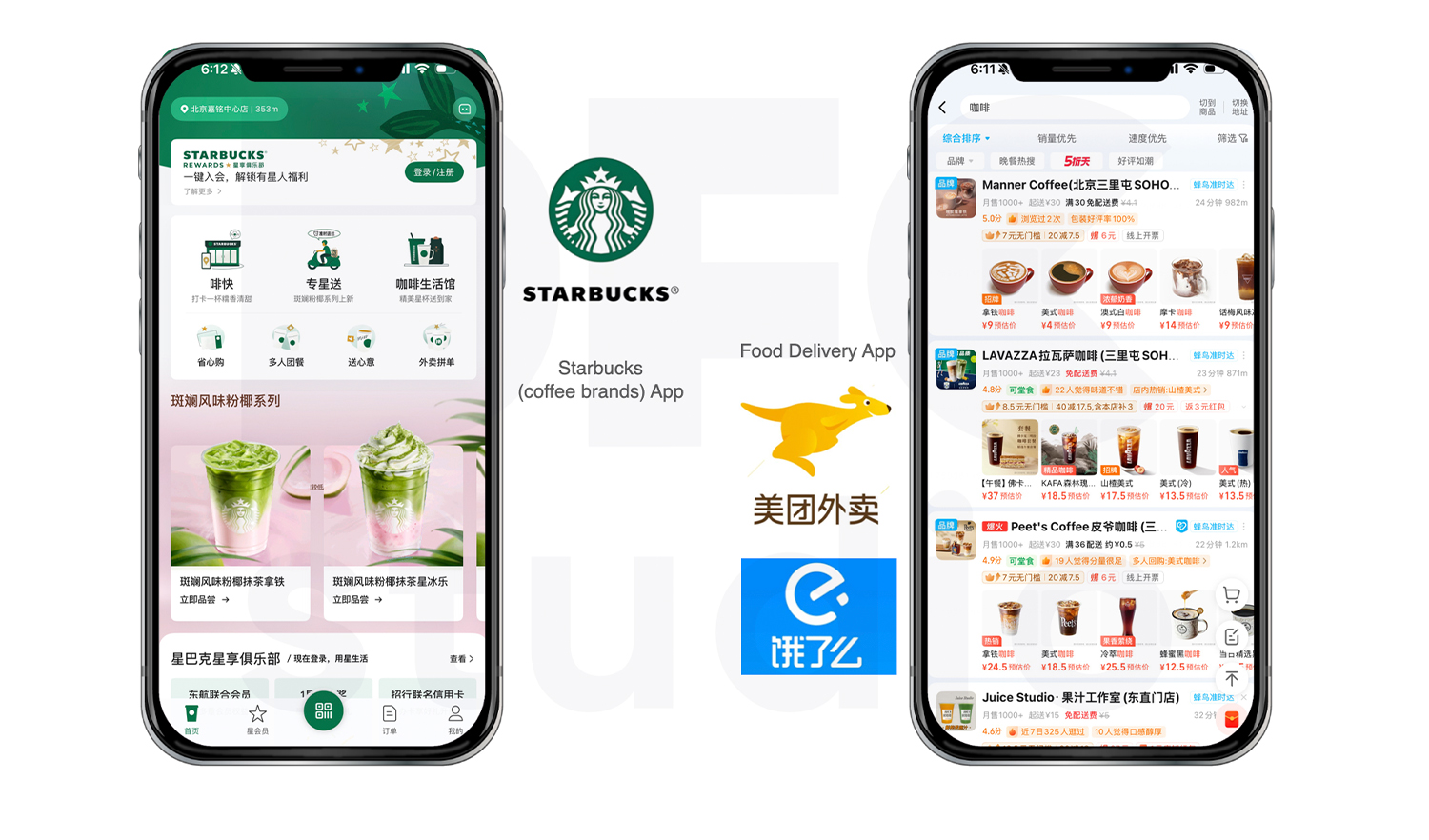

Online, the market is buzzing. By 2024, more than 100,000 coffee stores were listed on Taobao and Tmall, and online coffee sales rose 25.7% year-on-year. Through livestreams, influencer reviews, and group-buy deals, social commerce is bringing coffee consumption into every digital space.

Production, Processing, and Global Trends

Behind China’s fast-growing coffee market lies a sophisticated coffee production network that stretches from local farms to international export markets. Many brands now source their coffee beans directly from Yunnan province, investing in local cultivation, advanced processing methods, and quality control to ensure both flavor and consistency.

Yunnan’s coffee is becoming an important player in global export markets, with beans being shipped to Europe, Japan, and South Korea. These exports reflect China’s rising profile in global coffee production, as domestic farmers embrace sustainable agriculture and innovative processing methods such as washed, honey, and natural processing to create distinct flavor profiles.

At the same time, global coffee chains and domestic roasters are competing on craftsmanship and differentiation. Peet’s Coffee, for example, launched its affordable sub-brand Ora Coffee (RMB 9.9 per cup), combining artistry with mass-market reach. This hybrid model—affordable yet high-quality—perfectly captures current consumer preferences for accessible sophistication.

China’s coffee culture is also absorbing global trends. International flavors like Vietnamese drip, Malaysian durian coffee, and Thai-style cold brews have gained popularity in cities such as Nanning and Hangzhou. These cross-border influences enrich the domestic coffee market, offering more diverse choices and deepening the nation’s connection to global coffee traditions.

Despite rising coffee bean costs due to climate change and trade tariffs, major coffee chains have managed to keep retail prices steady. Their secret lies in operational efficiency—optimizing logistics, automating brewing systems, and leveraging data to predict consumer preferences. Milk remains the primary cost driver, while bulk sourcing and digital inventory management help maintain affordability.

China’s rapid urbanization is also fueling new consumption spaces. Coffee shops now appear in universities, airports, hospitals, and tourist destinations, ensuring coffee is always within reach. On average, 63 new coffee shops open each day, most led by affordable coffee chains. This accessibility has made coffee a symbol of a modern, fast-paced lifestyle embraced by the growing middle class.

Outlook: A Mature Coffee Culture with Global Vision

China’s coffee market stands at a fascinating crossroads—where affordability meets artistry, and local tradition meets global trends. Budget coffee chains will continue to dominate through scale and convenience, while specialty coffee brands attract loyal customers through craftsmanship, storytelling, and unique processing methods.

For investors and entrepreneurs, opportunities span the full value chain—from coffee production and roasting to brand franchising and tech-enabled retail. As China becomes not just a major consumer but also an emerging player in export markets, local farmers and roasters are connecting the country to the global coffee community.

Most importantly, the rise of China’s coffee culture is shaping new habits, values, and identities. For the urban middle class, coffee represents not just caffeine, but creativity, connection, and global belonging. Whether brewed in a minimalist specialty coffee bar or ordered through a mobile app, each cup reflects the dynamic intersection of modern taste and tradition.

From the farms of Yunnan to the glass towers of Shanghai, China’s coffee story continues to unfold—powered by innovation, diversity, and passion. As coffee beans travel from local soil to global shelves, they tell a larger story about China’s evolving place in the world: confident, creative, and caffeinated. If you would like to understand more about Chinese market, please feel free to contact us.

Want to Succeed in China? Download Our Free 84-Page Strategic Guide

Want to Succeed in China? Download Our Free 84-Page Strategic Guide

Keep up with the latest trends

DFC Studio is a Beijing-based digital marketing and e-commerce agency specializing in the Chinese market.

We help brands build visibility, engagement and sustainable online sales in China.

Our strength lies in a multicultural team combining deep expertise in China’s digital ecosystem with French-style management excellence.