From Pet Food to Pet Services: Key Trends in China’s Pet Economy for Global Brands

China’s pet economy is rapidly expanding, with a growing pet population and rising consumer spending on pet food, grooming, and retail.

China’s pet economy has entered a new era. With a pet population of 124 million and a market valued at RMB 3000 billion (≈ USD 418 billion), the country’s pet industry has expanded from a niche pastime into a mainstream lifestyle sector.

For global brands, this means the pet market is no longer just about food or accessories—it is about engaging with a profound cultural transformation where pets have become family members, emotional anchors, and everyday companions.

The New Generation of Pet Owners

The core of China’s pet population is driven by Millennials (post-90s), who account for over 40% of pet owners. Yet the most dynamic growth comes from Gen Z (post-00s), whose participation surged more than 15% year-on-year. These young consumers view pets not only as companions but also as expressions of identity and social connection.

In China, pets have become an integral part of people’s daily lives and online identities. On platforms like Xiaohongshu and Douyin, countless users share their pets’ adorable moments, routines, and even birthdays, turning their animal companions into small “influencers.”

Geography is also shifting. While Tier-1 cities such as Beijing and Shanghai remain influential, the fastest growth is now in Tier-3 and smaller cities, where disposable incomes are rising. For international brands, this requires a dual strategy: premium experiences for urban elites and affordable, trustworthy essentials for the emerging down-market.

Cats, Dogs, and the Rise of Exotic Pets

As the country’s birth rate continues to decline, many young people increasingly see their pets as family members — even as their “children.” This growing emotional bond reflects both changing social values and the search for companionship in modern urban life.

Within the pet population, cats have overtaken dogs, with more than 71 million compared to 53 million dogs. This reflects the reality of younger workers with limited space and time, who prefer “low-maintenance companionship.” Dogs, however, still drive higher per-pet spending—particularly in categories such as pet grooming, training, and health services.

Exotic pets are also on the rise, especially among Generation Z. Hamsters, reptiles, and aquariums are seen as “social currency” and often enhanced with digital features like AR ecosystems. For global brands, this presents opportunities to diversify offerings across species, with scalable consumables for cats, premium services for dogs, and innovation-driven ecosystems for exotics.

Pets as Family Members

A defining feature of China’s pet industry is the redefinition of pets as family. Once associated mainly with single lifestyles, pets are now integrated into households across demographics. In Shanghai, more than 60% of pet owners are married, and many involve children or even elderly parents in pet care. Pets provide companionship, a channel for self-healing, and a bridge for intergenerational bonding.

This has significant implications for branding. Chinese consumers are not simply purchasing food or services; they are investing in emotional well-being. Messaging that emphasizes love, care, and family resonates far more deeply than functional benefits alone.

The Changing Pet Retail Landscape

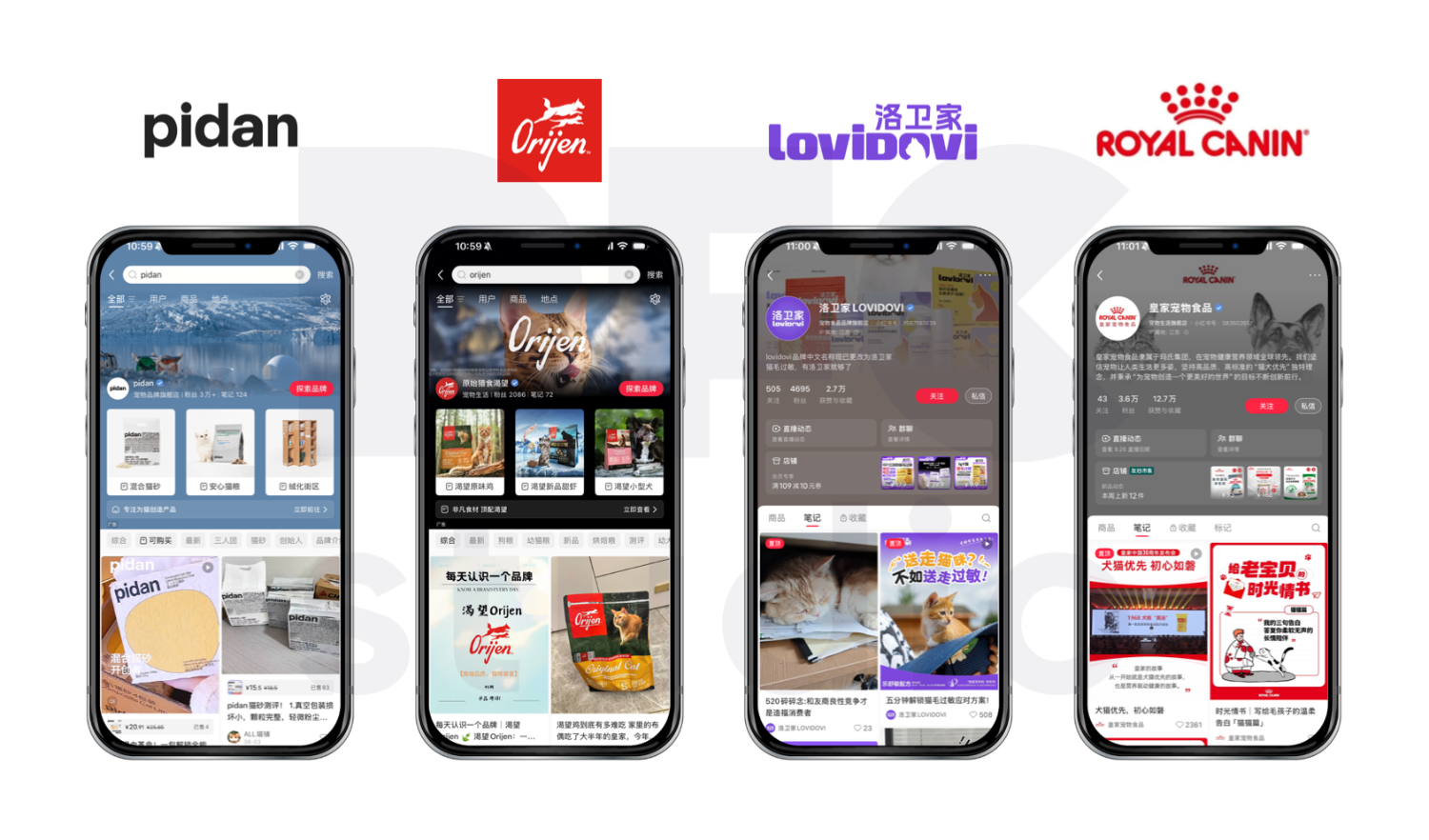

The pet retail landscape in China is undergoing rapid transformation. The pet food industry is shifting from basic feeding to health-driven nutrition, with wet food sales rising 260% year-on-year. Functional ingredients such as DHA, cranberries, and probiotics are becoming mainstream, reflecting consumer health trends. The pet food sector is a cornerstone of China’s pet economy. In 2025, the market is expected to grow by 6 to 8 percent, with a notable shift towards high-end and functional products. Brands like Orijen、Pidan、Lovidovi and Royal Canin are capitalizing on this trend by offering premium nutrition options that cater to health-conscious pet owners.

Health and wellness spending is also expanding. Pet insurance premiums rose by 129% in 2024, while supplements like fish oil and probiotics surged in sales. Meanwhile, connected devices such as smart collars and intelligent feeders are moving into the mass market. Pet grooming services, once considered a luxury, have become routine in urban areas.

Services and experiences are diversifying as well. Pet hotels are booming, alongside pet-friendly travel, restaurants, and retail. Airlines now offer in-cabin pet travel, and online platforms map out thousands of pet-friendly venues. Even end-of-life services, including funerals and memorials, have become professionalized, reflecting the emotional weight of pet ownership.

Strategic Implications for Global Brands

For global brands, China’s pet market offers opportunities across multiple dimensions. Premiumization remains strong, with consumers willing to treat pets with the same care as children or themselves. The pet retail landscape is increasingly omni-channel, combining e-commerce, livestreaming, and pet-friendly offline spaces. Localization is essential: Tier-1 consumers seek premium, emotionally resonant products, while Tier-3 pet owners prioritize affordability and reliability. Cross-sector partnerships also hold promise, whether through wellness-focused pet food industry innovations, lifestyle-oriented pet grooming and accessories, or hospitality and travel services such as pet hotels.

Conclusion

The rise of China’s pet economy is more than the story of a booming pet industry. It reflects a cultural shift in how people seek companionship, self-expression, and family connection. For global brands, entering this space means more than capturing share in the pet market; it means participating in a broader narrative of love, care, and belonging.

If you would like to build your business in China, please contact us for more information and business consulting service.

Want to Succeed in China? Download Our Free 84-Page Strategic Guide

Want to Succeed in China? Download Our Free 84-Page Strategic Guide

Keep up with the latest trends

DFC Studio is a Beijing-based digital marketing and e-commerce agency specialized in the Chinese market.

From strategizing your market entry to fostering brand recognition, our mission is to facilitate your expansion in order to boost your sales.

What sets us apart is our team of highly accomplished professionals, all of whom are graduates from renowned international universities.

This unique blend of bicultural expertise and deep understanding of the Chinese market positions us as a great partner to unlock your brand’s full potential in this thriving landscape.