Who are the major players in the Chinese logistics market?

The success of booming Chinese consumer market can be attributed to the efficient logistics system in the country.

Thanks to the well-established domestic logistics network with a strong domestic logistics provider, customers can receive packages on time, not only inside China as well as international transportation. Taking the 2023 “Double 11 Shopping Festival” * as an example, the total online transaction volume exceeded RMB 1138 billion, with 639 million parcels delivered on November 11th.

“Double 11” is the biggest Chinese online shopping festival of the year, the preselling events usually begin at the beginning of November and until the end of the month. Double 11 is considered as an equivalent of Black Friday or Boxing Day.

Taking Europe and the U.S. as examples, those countries have already created their own supply chain and operation coordination systems suitable for their market requirements. However, the business model in China is constantly developing and the logistic demands are frequently adjusting, and it will be a challenge for overseas companies to respond promptly.

Since the market demands between Western countries and China are different, international logistics companies (such as UPS, DHL, FedEx, etc.) are not adjusted enough in China and they need to work with local partners. Many of these international logistics players are creating joint venture companies with local leading third-party logistics to enjoy the strongest network possible to fit the local demand.

There are different kinds of logistic companies in China with different service standards and functions. From Air freight providing excellent services with a fast shipping time to land transportation offering affordable supply chain solutions, the wide range of transportation services answers any business requirement.

In mainland China, dozens of logistics providers and leading third-party logistics are fighting to answer the growing demand of the market.

Below are the key players of Chinese logistics companies:

SF Express – 顺丰 (Shun Feng)

Founded in 1991, SF Express (SF) is a leading integrated logistics service provider that is highly praised by Chinese consumers. SF offers different express standards with personalized services (standard; same day/speedy; large; cold chain; etc.) to meet the needs of different market segments.

As of the end of 2023, leveraging its all-cargo aircraft resources, SF Express has opened international routes to Asia, North America, and Europe, operating 97 all-cargo aircraft and accumulating over 60 international routes, 85 of which are owned by the company.

SF is more than a local logistic company as it began to build warehouses and provide international express logistic services. Nowadays, SF has grown into the world’s fourth-largest express logistic company and competes with the most renowned multinational corporations, thanks to their supply chain efficiency and their remarkable response time.

Currently, SF Express has achieved daily flight coverage in multiple Asia-Pacific countries, including Japan, Thailand, and Malaysia. SF Express is also one of the few Chinese companies capable of delivering shipments within 1 to 2 days in Southeast Asia, whereas most companies take about 5 to 6 days for the same process.

In a word, SF Express can deliver packages quickly with better service quality. It is recommended for urgent and higher price products.

JD Logistics – 京东物流(JDL)

JDL is now an independent logistics company established in 2017, which used to belong to JD Group (JingDong). Since 2018, JDL has launched a personal express service business unit, but JDL still mainly serves JD online shopping platforms both self-operated products and merchants solving complex supply chain problems.

The delivery speed and service quality are guaranteed with JDL. However, as e-commerce giants JD and Alibaba platform are competitors, the Alibaba merchants may be at risk when using JDL (sometimes Alibaba platform can not display JDL’s logistic information). Therefore, if you enter the JD platform as a partner, we suggest you give priority to JDL.

CNPL – 中国邮政速递物流(China Postal Express & Logistics)& EMS (CN)

China Postal is a comprehensive express logistics service provider and a subsidiary of China Post. China is a member of the UPU (Universal Postal Union). China Postal fulfills its duty and provides EMS (CN) service. As a state-owned enterprise, the company uses the postal network built by the state and it covers the widest delivery network in China.

To conclude, its advantage lies in the national endorsement of security and its far-reaching network/delivery points. China Postal Express & Logistics is suitable for mailing important letters & documents and to small villages or isolated spots. EMS also provides cross-border logistics services, and it has many partnerships around the world such as “La Poste” in France.

STO Express-申通 (Shen Tong), YUNDA Express-韵达(Yun Da), YTO Express-圆通 (Yuan Tong) & ZTO Express-中通 (Zhong Tong)

STO Express was established in 1993, Yunda Express was established in 1999, YTO Express was established in 2002 and ZTO Express was established in 2002. Despite their competitive relationships, the founders of these couriers come from the same town in Zhejiang province, near Hangzhou.

These 4 companies share similar delivery efficiency, price, and quality. By relying on the capability of delivering paces in time with a relatively lower price, they quickly occupied a large number of logistics market shares. In 2018, they all joined an alliance created by Alibaba called “Cainiao”. Meanwhile, as Alibaba’s strategic partners, they quickly dominated most logistics services of the Taobao platform.

In a word, cost-effectiveness is the key advantage of STO, Yunda, YTO, and ZTO, perhaps small service gaps might exist in different regions, but these four couriers are the most suitable solutions for lower price but higher frequency consumer goods.

Self-service package drop-off and pick-up stations: a New solution for express delivery:

Beginning in 2015, a new solution for express delivery and e-commerce logistics has been developed across the nation. Unlike traditional express delivery services, the self-service package drop-off and pick-up stations are placed in the residential areas, where people can easily pick up their packages from. Simply enter the pickup code to collect your parcel at any time of the day. The service is free but you will be charged with extra fee if the parcel is stored over a certain period. Some customers are opposed to this service since parcels might be deposited without their consent. The competition for these self-service stations is also fierce in China as Cainiao(菜鸟) and Hive Box(蜂巢) are the main players.

Conclusion

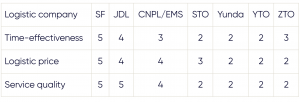

The above chart shows local key players of logistic performances in different measures (from 1 to 5).

For products with a higher price which requires customized and efficient services, it’s recommended to give priority to a timeliness logistics company.

For lower-priced customer goods with large market demands and high re-purchase needs, logistic costs will be considered first.

Trends in China’s Logistics Industry

Cross-border E-commerce Leads the Internationalization of China’s Logistics.

As the Regional Comprehensive Economic Partnership (RCEP) took effect on January 1, 2022, it has spurred further growth in cross-border e-commerce by significantly reducing tariffs and improving trade conditions. This has lowered the cost for cross-border sellers looking to expand overseas. Moreover, the increasing market demand is expected to boost the development of e-commerce infrastructure, including logistics and warehousing, particularly in Southeast Asia, leading to a substantial growth in the number of Chinese sellers and buyers in the region.

Rise in Demand for Tongcheng(同城) Logistics.

The Covid-19 has significantly shifted consumer behavior towards online shopping, with a combination of online ordering and offline delivery becoming the norm in the post-pandemic world. Tongcheng delivery services mainly involve food delivery, fresh groceries, flowers, and supermarket products. The key players in this sector include food delivery platforms like Meituan(美团)and ele.me(饿了么), specialized B2C platforms focused on immediate delivery sectors such as DDL(叮咚买菜) for pharmaceuticals, Freshippo(盒马鲜生) for groceries, and platforms like Lalamove(货拉拉) focusing on moving and freight.

Traditional express delivery companies such as SF Express, YTO Express, and ZTO Express also play a significant role.

New Retail Transforms the Express Sector.

Live commerce has become incredibly popular in China. By leveraging fast and reliable express services, live commerce platforms are able to eliminate middlemen, directly connecting factories with consumers. This streamlining not only helps brands tap into and cater to potential consumer groups but also ensures that the feedback from live sales can quickly influence production decisions, thus reducing customer waiting times.

Keep up with DFC-Studio to learn more about social media and social commerce in China.

Obtenez une copie gratuite de notre E-book Chine : L’essentiel à savoir

Obtenez une copie gratuite de notre E-book Chine : L’essentiel à savoir